Delivering on our growth strategy while we take further actions to reduce costs

Electrolux North America continues to deliver strong sales and earnings growth, while Europe continues to suffer from weak demand. In response to the current market situation in Europe, we will initiate activities to further adapt the Group’s cost structure. Although the situation in Europe remains challenging, it is encouraging to note that the organic growth for the Group in the third quarter of 4.9% exceeds our target of 4% and shows that we continue to deliver on our innovation and growth strategy. Emerging markets continued to show strong top line growth, while earnings were impacted by negative currency movements.

North America presented another quarter of strong earnings driven by volume growth in core appliances. Organic sales growth amounted to 8% supported by favourable market development, new distribution channels and a positive product mix. The housing market recovery continues to stimulate appliance demand and we are therefore raising our estimate for demand in the US to increase by 7-9% for the full year of 2013.

Our European operations continued to be affected by challenging market conditions, especially in Southern Europe, having a negative impact on volumes and earnings. However, organic sales remained unchanged year-over-year with some positive signs in the UK, Nordics, and Germany. In response to the current market situation in Europe, we have initiated a new overhead reduction program to adapt the Group’s cost structure. We expect the European demand for appliances to decline by 1-2% for the full year of 2013.

Today, we are also announcing the next phase of the Group’s manufacturing footprint program to improve our cost competitiveness. The program was initiated during 2011 and planned to be fully executed 2014 -2016. The decision has now been taken to close our factory for refrigerators and freezers in Orange, Australia, and concentrate production to the major appliances plant in Rayong, Thailand. In addition to this, an investigation will be initiated regarding the Electrolux manufacturing setup for Major Appliances in Italy.

The charges related to the overhead cost reduction program and the manufacturing footprint program will be taken in Q4 2013 and in 2014 and are estimated to be around SEK 3.4 billion. The total benefit is expected to be approximately SEK 1.8 billion on an annual basis. We expect these actions to have a positive impact on our cost position and contribute to our margins going forward.

Electrolux sales in Latin America showed continued organic growth despite the slowdown in the Brazilian market. Earnings continued to be positively impacted by price increases and improved product mix, however, large negative currency fluctuations affected earnings as the Brazilian Real weakened considerably against the US Dollar. For the Group, we experienced yet another quarter of negative currency movements which affected earnings across all business areas. The total impact of currency in the quarter was SEK -519m of which approximately half was related to Latin America.

Asia/Pacific reported an organic sales growth of over 20% in the third quarter. China continued to show strong growth and Electrolux sales and market shares increased in Australia. As previously announced, we are launching a new and innovative range of products on the Chinese and Southeast Asian markets. Our ambition is to develop a solid, growing, position in the premium segment in these markets. Consequently, investments relating to the launch affected the earnings negatively in the quarter and will continue to do so in Q4.

The difficult measures announced today combined with our strategic focus on growth in emerging markets and increased consumer relevant product innovations make us convinced that Electrolux is well positioned to meet and exceed our long-term key financial targets.

Stockholm, October 25, 2013

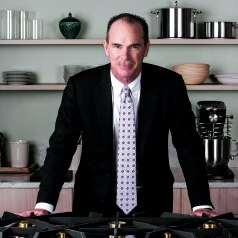

Keith McLoughlin

President and CEO

Electrolux discloses the information provided herein pursuant to the Securities Market Act and/or the Financial Instruments Trading Act.

The information was submitted for publication at 08.00 CET on October 25