The Electrolux share

Total shareholder return for the Electrolux B share has in average been 14% annually during the past ten years, compared to 13% for the OMX Stockholm Return Index. The Electrolux share is listed on the exchange Nasdaq Stockholm.

Total return

14%

ELUX B (10 years)

Dividend

8.50 SEK

per share (2018*)

*Proposed by the Board

payout ratio

64%

(2018*)

*Proposed by the Board

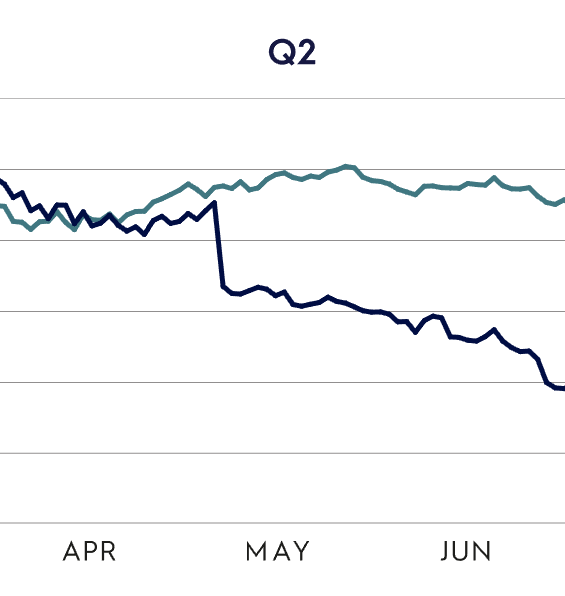

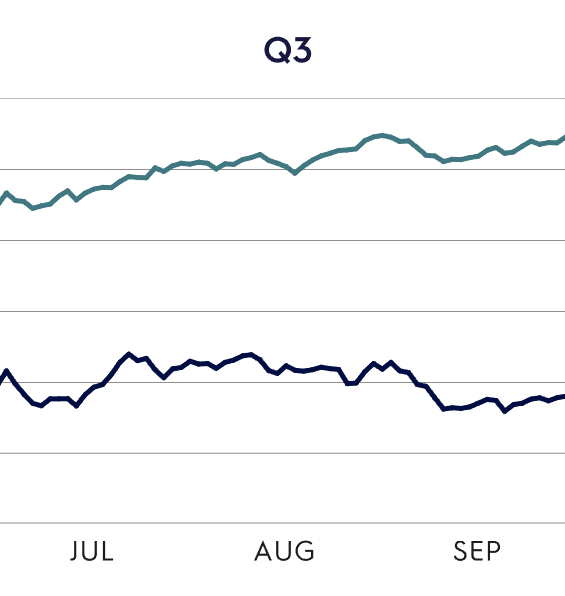

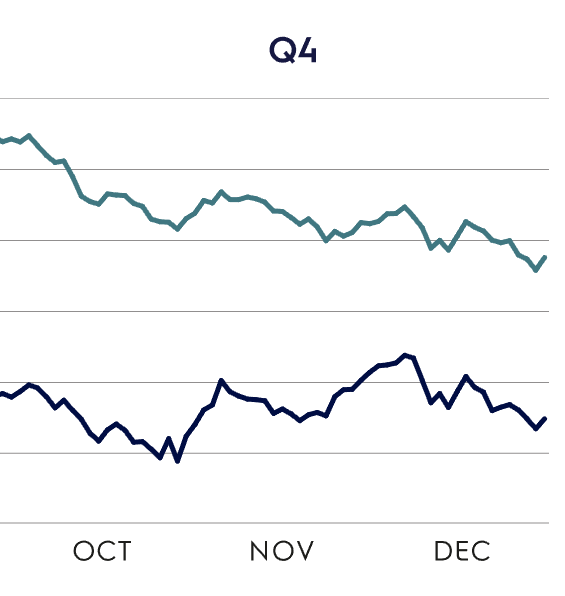

- Electrolux B Share

- OMX Stockholm Index

Performance of the Electrolux B share

left arrow

right arrow

Electrolux B Share

OMX Stockholm Index

Quarter 1, 2018

Quarter 2, 2018

quarter 3, 2018

quarter 4, 2018

Q4 2017 report comments

Strong finish to the 2017 year with organic growth of 4% and an operating margin of 6.1% driven by most business areas, of which four achieved a margin above 8%.

ELECTROLUX INiTIATIVES

- Cost-based price increases implemented in North America and Latin America.

- Strong focus on driving mix through several innovations in cooking.

- Re-engineering investments in the U.S. announced to strengthen competitiveness.

- Official launch of the AEG brand in China.

- Acquisition of Schneidereit adding functional sales expertise for Professional Products.

EXTERNAL FACTORS

- Favorable market trends across key markets, including Europe and the U.S.

- Higher cost inflation, primarily raw material.

- U.S. anti-dumping duties on imported washers.

- U.S. tax reform in law on December 22, 2017.

Q1 2018 report comments

Continued focus on profitable growth, with market share gains in core brands, resulting in organic growth of 1.8% and solid underlying margins. First round of cost-based price increases implemented towards the end of Q1 to mitigate higher raw material costs.

ELECTROLUX INiTIATIVES

- Further price increases announced in key markets, primarily in North America and Latin America.

- Dividend increased to SEK 8.30 from 7.50 per share, decided by AGM.

- Celebrating Frigidaire 100 years.

EXTERNAL FACTORS

- Overall positive market demand, but decline in industry shipments in North America, Latin America and Australia.

- New range of connected refrigerators launched in Asia/Pacific.

- Tariffs on steel (Section 232) implemented in the U.S.

- Increased currency headwind, mainly in Latin America.

- Provision set relating to an investigation by the French Competition Authority.

Q2 2018 report comments

Organic growth across most business areas with continued market share gains. Implementing price increases in a challenging cost environment while investing in brand and innovation.

ELECTROLUX INiTIATIVES

- Management team changes and new Group CFO.

- Several important launches; new cordless vacuum cleaner Pure F9, new range of induction hobs and the next generation laundry for professional users.

- Home Care & SDA completed its product portfolio review after divesting its North American commercial and central vacuum cleaner businesses.

Q3 2018 report comments

Strong focus on implementing cost-based price increases and an overall good operational performance despite increasing headwinds. The product mix continued to improve driven by premium brands and product launches.

ELECTROLUX INiTIATIVES

- Implementing announced price increases in several markets with effect 2019.

- Acquisition of SPM Drink Systems expands Professional Products’ current beverage offering.

- Partnership with smart kitchen start-up "Drop".

- Electrolux tops new Swedish sustainability ranking.

EXTERNAL FACTORS

- Weaker retailer demand due to higher industry prices. Solid European market.

- U.S. tariffs for imports of certain components and products from China in place.

- Accelerating currency volatility in emerging markets, especially Latin America.

- Provision announced for unfavourable court ruling in France.

EXTERNAL FACTORS

- Major U.S. private label customer filed for Chapter 11.

- French antitrust proceeding concluded.

- Currency fluctuation in Latin America.

IR activities and value creation

Electrolux overall goal is to create value for its shareholders and we place great emphasis on the communication and interaction with the capital market.

Questions in focus by the capital markets in 2018

The dialogue with the capital markets focuses on improving the understanding of the operations, execution of the strategy and Electrolux financial position. The telephone conferences from earnings call presentations in 2018 are available at www.electroluxgroup.com