- Continued weak demand in Electrolux major markets in 2011.

- The North American market decreased by 4%. The European market was unchanged.

- Net sales increased by 1.9% in comparable currencies. Acquisitions had an impact on net sales by 1.7%.

- Sales were positively impacted by volume growth in emerging markets, while lower sales prices had a negative impact on net sales.

- Lower sales prices and higher costs for raw materials had an adverse impact on operating income.

- Solid results in a tough environment for operations in Latin America, Asia/Pacific and for Small Appliances and Professional Products.

- Average number of employees increased to 52,916 (51,544).

The Group’s operations include products for consumers as well as professional users. Products for consumers comprise major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens, floor-care products and small domestic appliances. Professional products comprise food-service equipment for hotels, restaurants and institutions, as well as laundry equipment for apartment-house laundry rooms, launderettes, hotels and other professional users.

In 2011, appliances accounted for 86% (86) of sales, professional products for 6% (6) and small appliances for 8% (8).

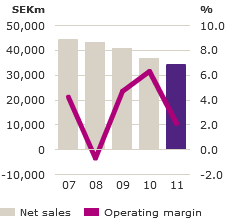

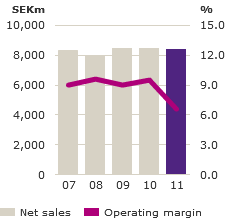

Major Appliances Europe, Middle East and Africa

Overall demand for appliances in Europe 2011 was unchanged in comparison with the previous year. Demand in Western Europe declined by 3%. Demand declined in for Electrolux important markets in Southern Europe such as Italy. Demand in Eastern Europe rose by 9%, mainly as a result of increased demand in Russia.

Group sales in Europe declined in 2011, mainly because of lower sales prices and a negative country mix. Higher sales in Eastern Europe and lower sales in Western Europe had a negative impact on the Group’s sales mix. The acquired company Olympic Group in Egypt contributed to increased sales.

Operating income for 2011 declined. Costs for measures to reduce overheads in Europe amounting to SEK 500m and WEEE related costs in Hungary totaling SEK 190m were charged to operating income in 2011. In addition, lower sales prices, a negative country mix and higher costs for raw materials had a negative impact on operating income. Meanwhile, the product mix improved as a result of the successful launch of new premium products.

The contribution from Olympic Group including related acquisition adjustments was slightly negative. Read more about the acquisition of Olympic Group, also in Note 26.

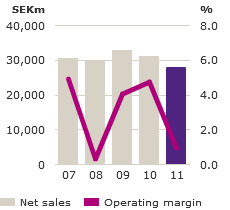

Major Appliances North America

Market demand in North America for core appliances declined by 4% during the year. Major appliances, including room air-conditioners and microwave ovens, declined by 1%. Room air-conditioners showed strong growth during the year, rising by almost 20%.

Group sales in North America decreased compared to the year-earlier period due to lower sales volumes.

Operating income declined mainly due to lower sales volumes, reduced capacity utilization in production. In addition, increased costs for raw materials, sourced products and transportation had a negative impact on operating income.

Measures to reduce overheads amounting to SEK 15m were charged to operating income for 2011.

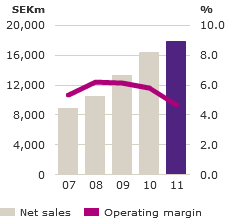

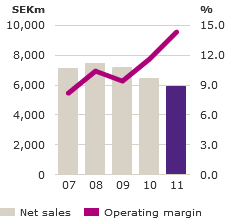

Major Appliances Latin America

Market demand for appliances in Brazil is estimated to have increased in 2011 compared to the previous year. Several other Latin American markets showed favorable growth during the year.

The Group’s sales rose as a result of higher sales volumes and Electrolux continued to capture market shares in Brazil and in other Latin American markets, the latter of which accounted for about 22% of consolidated sales in Latin America during 2011. Sales have been positively impacted by the acquisition of the Chilean appliances manufacturer CTI.

Operating income declined compared to the previous year on the basis of a weaker customer mix and increased costs for raw materials. The consolidation that has taken place among several retailers in the Brazilian market had an adverse impact on the customer mix compared to 2010, although to a lesser extent during the latter part of 2011.

The contribution from the acquisition of CTI, including related acquisition adjustments, was positive. Read more about the acquisition of CTI, also in Note 26.

Major Appliances Asia/Pacific

Market demand for appliances in Australia is estimated to have increased in 2011 compared to the previous year.

Group sales declined, primarily as a result of price pressure in the market. The strong AUD enabled producers that import products to reduce their prices.

Operating income declined for 2011, mainly as a consequence of lower sales prices, increased costs for raw materials and sourced products.

Market demand in Southeast Asia and China is estimated to have grown in 2011 compared to the previous year. Electrolux sales in markets in Southeast Asia and China display strong growth and Electrolux market shares are estimated to have grown. The operations in Southeast Asia showed a favorable profitability throughout 2011.

Measures to reduce overheads amounting to SEK 20m had a negative impact on operating income for the whole region.

Small Appliances

Market demand for vacuum cleaners in Europe and North America declined in 2011, compared with the previous year.

Group sales increased in comparable currencies compared to the previous year, primarily as a result of higher sales volumes and an improved product mix. The acquisition of CTI’s subsidiary Somela, a small appliances manufacturer in Chile, made a positive contribution to sales.

Operating income decreased, primarily due to higher costs for sourced products and lower sales prices. An improved product mix and sales growth for small domestic appliances though had a positive impact on operating income.

Measures to reduce overheads amounting to SEK 45m were charged to operating income in 2011.

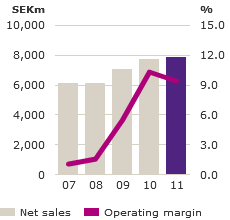

Professional Products

Market demand in Europe for food-service equipment is estimated to have declined in 2011 compared to the previous year.

Operating income for food-service equipment deteriorated due

to lower sales volumes primarily in Southern Europe, where

Electrolux commands a strong position, and increased raw-material costs. Price increases largely offset the higher costs for raw materials.

Market demand for professional laundry equipment is estimated to have declined somewhat in the Group’s major markets in Western Europe and sales volumes declined. Replacement products are accounting for a large share of the current demand in the market at the same time as demand for spare parts is rising.

Operating income for professional laundry equipment improved however, compared to 2010, as a result of price increases and higher sales volumes, which offset the rising costs of raw materials.

Shipments of core appliances in North America  A total of approximately 37 million core appliances were sold in North America in 2011, which corresponds to a decline of 4% compared to 2010. |

Shipments of core appliances in Europe, excl. Turkey  A total of approximately 71 million core appliances were sold in Europe in 2011, which were in line with the previous year. Demand in Western Europe declined by 3% while Eastern Europe increased by 9%. |