2011 was a year in a challenging market. 2011 was also a year in which we took a number of strategic decisions that will be highly significant for our long-term development. We are now intensifying our focus on growth. We acquired CTI and Olympic Group, which combined with strong organic growth have increased our pro-forma sales in growth markets from 25% in 2009 to 35% in 2011.

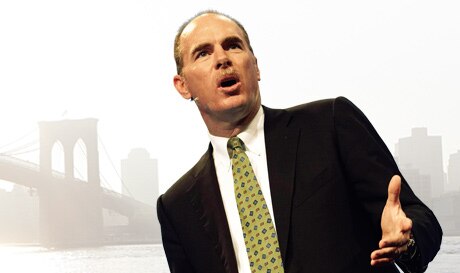

My first year as President and CEO of Electrolux has passed. It was an eventful and dramatic year, particularly against the backdrop of rising raw-material prices and the sharp fall in prices in our major markets, while at that same time demand in mature markets weakened. All of this took place in an environment characterized by increasing socio-economic insecurity. 2011 also marked a year in which we took a number of strategic decisions that will be highly significant for our long-term development. While profit for 2011 did not reach the same high level as for 2010, Electrolux remains a very strong company – and with more distinct focus on growth. Allow me to describe a few of the key events that occurred during 2011 that demonstrate how we strengthened Electrolux in line with our strategic focus.

My first year as President and CEO of Electrolux has passed. It was an eventful and dramatic year, particularly against the backdrop of rising raw-material prices and the sharp fall in prices in our major markets, while at that same time demand in mature markets weakened. All of this took place in an environment characterized by increasing socio-economic insecurity. 2011 also marked a year in which we took a number of strategic decisions that will be highly significant for our long-term development. While profit for 2011 did not reach the same high level as for 2010, Electrolux remains a very strong company – and with more distinct focus on growth. Allow me to describe a few of the key events that occurred during 2011 that demonstrate how we strengthened Electrolux in line with our strategic focus.

February 2, 2011 Presentation of 2010 year-end report and implementation of an important reorganization

As we leave a successful 2010 behind us – a year in which we achieved three of our four financial goals – we restructure the organization to enhance the focus on our products. We create “The Innovation Triangle”, which aims to promote closer collaboration within the Group between the marketing, product development and design units. The objective is to develop more successful products while also accelerating the pace of the development process by leveraging synergies at global and regional levels. To focus and deepen the significance of the innovation triangle, we now have, for the first time in the history of Electrolux, a Chief Technology Officer, a Chief Marketing Officer and a Chief Design Officer on the Group Management team. As a result of this change, we have created a forum for highly dynamic discussions in the management team. One of the principal elements of the new cooperation is the introduction of uniform launch criteria throughout the Group. Among other factors, this stipulates that no product may reach the market unless it is the preferred choice of at least 70% of a consumer test panel in relation to similar alternatives.

March 18 Electrolux named one of the world’s most ethical companies

Irrespective of which products and solutions we develop, we endeavor to continuously improve our products’ performance. Our ambition is not only confined to product development, but to all of our ethical work and our involvement in such issues as the ever-increasing problems of water shortages in rapidly growing metropolitan areas of growth countries and the pollution of our seas. After many years of hard and resolute work, we received recognition of this when the Ethisphere Institute, a think-tank dedicated to examining the ethical and social work of companies throughout the world, named Electrolux as one of the world’s most ethical companies. In addition to our ethical framework, the assessment was based on our entire sustainability program, including our investments in innovations. Additional confirmation of our sustainability strategy during the year was, of course, our inclusion, for the fifth consecutive year, in the prestigious Dow Jones Sustainability World Index (DJSI World).

April 4 We implement price hikes in North America

Already back in early 2011, we announced our intentions to raise prices for all products in the US market for the purpose of restoring profitability. On April 4, we raised prices and a second price increase was also implemented in August. As sales in the US have largely been driven by promotions and thus the net impact of the price increases was limited in 2011. In early 2012, we have started raising prices in some of our major markets in Europe. We realize, of course, the challenges that this entails. The weak economy in Europe and the US means that we will receive no support from strong market growth. However, we are forced to act due to the steep cost increases that has impacted us over the past two years mainly for steel, plastics and sourced products.

August 22 We made our second acquisition

At the beginning of my CEO statement, I mentioned that we achieved three of our four financial goals in 2010. We achieved our goals for operating margin, capital-turnover rate and return on net assets, although we did not meet our growth goal of 4%. We are now intensifying our focus on growth. During the year, we acquired CTI and Olympic Group, which combined with strong organic growth increased our pro-forma sales in growth markets from 25% in 2009 to 35% in 2011. These acquisitions not only enable us to become leaders in new markets, but also to quickly leverage synergies associated with the new companies in a global organization that works efficiently across borders. A prioritized aspect of our strategy is to continue to increase sales in such growth markets as Latin America, Africa and Asia. The rapidly emerging middle class in cities in these markets constitutes a key target group. Based on consumer insight, we will use our global platform to continue to develop products specifically adapted to regional requirements, such as our Keyhole Hob in Asia and our Ultra Clean washing machine in Brazil. By continuing to grow organically, the share of our sales in growth markets will reach 50% within a five-year period. Through further acquisitions, this goal could be achieved even sooner.

But naturally, expansion must be profitable and generate shareholder value.

September 5 We discuss key industry trends at the IFA trade show in Berlin

At the IFA trade fair in Berlin, one of the world’s largest fairs for consumer electronics and household appliances, highly relevant trends for our business were discussed. At Electrolux, we continuously engage in dialog with users of our products. Our in-depth insight into what consumers want and need provides us with an important competitive edge. In 2011, we initiated a number of activities aimed at providing users with the best products and the market’s best service. This is building an even stronger platform for profitable growth for Electrolux. At the IFA trade show, we displayed our new range of AEG products and during the second half of 2011 the AEG products have started to gain market shares in Europe and contributed to a positive mix.

November 15 We host our capital markets day and among other things announce measures to reduce costs

Appliance volumes in North America in 2011 are on a par with 1998 levels and are down about 25% on the peak levels noted in 2006. Volumes in Western Europe are in line with 1999 levels and are more than 10% lower than the corresponding peak level. For the years ahead, it is difficult to see what could trigger a recovery in demand in our mature markets that would return them to their former peak levels. In conjunction with our annual capital markets day, we therefore announced new measures aimed at continuing to adapt production capacity, costs and the organization to prevailing market conditions. We must put our foot on the accelerator and brake at the same time, which is a difficult balancing act. It means that we accelerate our production capacity in growth markets, such as Southeast Asia and China, to ensure that we do not lose our positions. Over the past years, we have grown strongly in Southeast Asia and, by adjusting our product offering, we are achieving profitability in China. A globally optimized manufacturing structure will ensure that we are more competitive in all of our markets.

February 2, 2012We present our year-end report for 2011 and summarize a tough but eventful year

We post an underlying operating income of SEK 4 billion for 2012. Although this is SEK 2 billion below the preceding year’s level, it is a solid result in light of the challenges we faced in our major markets in North America and Europe. Lower sale prices, increased raw-material costs and weak demand in our key mature markets meant that we experienced a headwind corresponding to nearly SEK 4 billion. As I described earlier, we acted and took strategic decisions to strengthen our competitiveness to reduce the impact on income caused by these external circumstances. At the same time, we have not been afraid to act aggressively by acquiring new companies and investing in new products. Several of our businesses continue to perform strongly. The operations in Latin America and Asia are recording new solid results, and profitability for the professional business and small appliances business remains at a very high level.

Although 2011 was an interesting and eventful year, it feels good to leave it behind us and cast our gaze to the future. The implementation rate of our strategy is increasing in order to consolidate our position as a global leader in appliances. In addition to integrating the acquired companies, we will also accelerate the pace of production launches in 2012. We will utilize the know-how we possess in our professional business. We will be even better at leveraging our position as the only company in our industry to offer products and solutions for both consumers and professional users in over 150 countries.

We see a continued period of volatility and uncertainty ahead of us in the socio-economic landscape. As such, we will manage the company in a way that keeps us prepared to address this unpredictability, while keeping an eye on the horizon and investing in our future. By maintaining strong control over costs and being receptive to new business opportunities, we will further strengthen our positions in growth markets and in new product areas. In one year’s time, Electrolux will be an even stronger company. To assist me in achieving this goal, I have a dedicated, international organization with talented employees who work tirelessly to ensure that Electrolux continues to generate sustainable value for all shareholders.

By continuing to grow organically, the share of our sales in growth markets will reach 50% within a five- year period.

Photographer: Victor Brott

By maintaining strong control over costs and being receptive to new business opportunities, we will further strengthen our positions in growth markets and in new product areas.

Stockholm, February 2012

Keith McLoughlin

President and CEO