The operations of Electrolux are exposed to a number of strong external factors that affect the Group’s opportunities to increase profitability and return, and thus its ability to achieve the Group’s financial goals. In 2011, profitability was negatively impacted primarily by the following factors.

Higher costs for raw materials

Raw materials account for a large share of the Group’s costs. In 2011, Electrolux purchased components and raw materials for approximately SEK 41 billion, of which the latter represented approximately SEK 20 billion. The raw materials to which the Group is primarily exposed comprise steel, plastics, copper and aluminum, of which the share of the total attributable to plastics has increased over the past few years. Raw material market prices rose at the start of 2011 to thereafter decline. The total cost of raw materials in 2011 was about SEK 2 billion higher than in 2010.

Price development, plastics and steel

Price pressure in the major

Electrolux markets

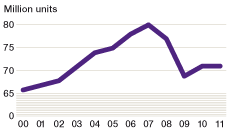

Shipments of core appliances in Europe, excl. Turkey

Shipments of core appliances in US