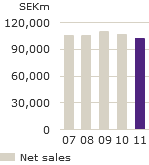

Net sales

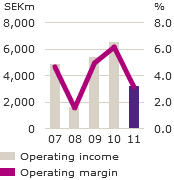

Operating income and operating margin1)

Raw material

Weak market

Increased efficiency

Non-recurring costs

Price pressure

6.1%

3.9%

3.1%

Operating margin

Raw material

Weak market

Increased efficiency

Non-recurring costs

Price pressure

6.1%

3.9%

3.1%

Operating margin

Raw-material costs were SEK 2 billion higher than in 2010.

CloseWeak market conditions in mature markets decreased sales and capacity utilization within manufacturing.

CloseImprovements including increased efficiency, e.g., through global synergies and previous restructuring had a positive impact on earnings.

CloseNon-recurring costs of SEK 825m were charged to operating income for overhead reductions and WEEE related costs for earlier years.

ClosePrice pressure was intensive during the year, particularly in Europe and North America.

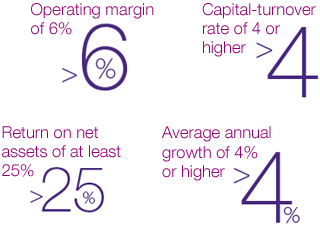

Close2010 marked the first year in which Electrolux – in its current structure – achieved its operating margin goal of 6% over a full year, excluding items affecting comparability.

CloseElectrolux achieved an operating margin of 3.9% despite higher raw-material costs and turbulent conditions in the Group's major markets of Europe and North America.

Close1) Excluding items affecting comparability

appliances such as vacuum cleaners sold under esteemed brands like Electrolux, AEG, Eureka and Frigidaire.

appliances such as vacuum cleaners sold under esteemed brands like Electrolux, AEG, Eureka and Frigidaire.