- Cash flow was negatively impacted by acquisitions and the decline in earnings.

- Capital expenditure was in line with the previous year, amounting to SEK 3,163m (3,221).

- R&D costs increased to 2.0% (1.9) of net sales.

Operating cash flow

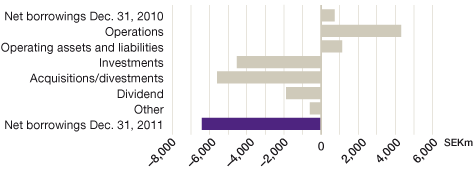

Cash flow from operations and investments in the full year of 2011 amounted to SEK –4,650m (3,206). The acquisitions of CTI and Olympic Group have impacted cash flow by SEK –5,855m. Excluding acquisitions and divestments, cash flow from operations and investments amounted to SEK 906m (3,199). The decline referred mainly to the deterioration in income.

The Group’s ongoing structural efforts to reduce tied-up capital has contributed to the cash flow from operating assets and liabilities.

Outlays for the ongoing restructuring and cost-cutting programs amounted to approximately SEK –660m in 2011.

Investments during the year referred mainly to new products and production capacity.

Capital expenditure

Capital expenditure in property, plant and equipment in 2011 amounted to SEK 3,163m (3,221). Capital expenditure corresponded to 3.1% (3.0) of net sales. Investments during 2011 referred mainly to investments within production for efficiency improvements for new products and production capacity.

Costs for R&D

Costs for research and development in 2011, including capitalization of SEK 374m (396), amounted to SEK 2,043m (1,993), corresponding to 2.0% (1.9) of net sales.

For definitions, see Note 30.

Cash flow and change in net borrowings