- Net sales for 2011 increased by 1.9% in comparable currencies. Acquisitions had an impact on net sales by 1.7%.

- Sales growth in Asia/Pacific, Latin America and Small Appliances offsets lower sales in Europe and North America.

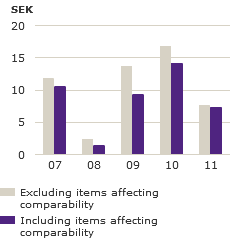

- Operating income amounted to SEK 3,155m (6,494), corresponding to a margin of 3.1% (6.1), excluding items affecting comparability.

- Operating income declined mainly due to lower sales prices and increased costs for raw materials.

- Income for the period was SEK 2,064m (3,997).

- Earnings per share amounted to SEK 7.25 (14.04).

Net sales

Net sales for the Electrolux Group in 2011 amounted to SEK 101,598m, as against SEK 106,326m in the previous year. Changes in exchange rates had a negative impact on net sales. The acquisitions of Olympic Group in Egypt and CTI in Chile had a positive impact on net sales by 1.7%. Net sales were slightly positive in comparable currencies, excluding acquisitions.

Strong sales growth in Latin America and Asia/Pacific offset lower sales in mature markets as Europe and North America. Olympic Group and CTI are included in Electrolux consolidated accounts for 2011 as of September and October, respectively, see Structural changes and acquisitions.

| Change in net sales | |

| % | 2011 |

| Changes in Group structure | 1.7 |

| Changes in exchange rates | –6.3 |

| Changes in volume/price/mix | 0.2 |

| Total | –4.4 |

Operating income

Operating income for 2011 decreased to SEK 3,017m (5,430), corresponding to 3.0% (5,1) of net sales. Weak demand in Electrolux main markets, lower sales prices and increased costs for raw materials had an adverse impact on operating income for 2011.

The contribution from the acquired companies Olympic Group and CTI including related acquisition adjustments was slightly negative. Expenses related to the acquisitions amounted to SEK 99m in 2011, see Structural changes and acquisitions.

Electrolux has been tangibly affected by the decline in consumer confidence in the mature markets. To improve cost efficiency, a number of cost-savings activities are being implemented, see Structural changes and acquisitions. Activities to reduce staffing levels in all regions were initiated in the fourth quarter of 2011 and will continue in 2012. Non-recurring costs for these activities have been charged to operating income in the amount of SEK 635m. In addition, non-recurring historical WEEE1) related costs in Hungary for the period 2005 to 2007 amounting to SEK 190m have been charged to operating income.

1) Producer responsibility related to Waste Electrical and Electronic Equipment (WEEE).

| Non-recurring costs | |

| SEKm | 2011 |

| Reduction of staffing levels in Europe | 500 |

| WEEE related costs, Europe | 190 |

| Reduction of staffing levels, North America | 15 |

| Reduction of staffing levels, Asia/ Pacific | 20 |

| Reduction of staffing levels, Small Appliances | 45 |

| Reduction of staffing levels, Group functions | 55 |

| Total | 825 |

Items affecting comparability

Operating income for 2011 includes items affecting comparability in the amount of SEK –138m (–1,064), referring to restructuring provisions, see table in Structural changes and acquisitions. Excluding items affecting comparability and the non-recurring costs described above, operating income for 2011 amounted to SEK 3,980m (6,494), corresponding to a margin of 3.9% (6.1).

Financial net

Net financial items declined to SEK –237m (–124). The decline is mainly due higher interest rates and increased net debt. The acquisitions of Olympic Group and CTI have impacted net debt.

Income after financial items

Income after financial items decreased to SEK 2,780m (5,306), corresponding to 2.7% (5.0) of net sales.

Taxes

Total taxes in 2011 amounted to SEK –716m (–1,309), corresponding to a tax rate of 25.7% (24.7).

Income for the period and earnings per share

Income for the period amounted to SEK 2,064m (3,997), corresponding to SEK 7.25 (14.04) in earnings per share before dilution.

Effects of changes in exchange rates

Compared to the previous year, changes in exchange rates for the full-year 2011 had a positive impact on operating income, including translation, transaction effects and hedging contracts and amounted to SEK 150m.

The effects of changes in exchange rates referred mainly to the operations in Europe, Latin America and Asia/Pacific. The strengthening of the Australian Dollar and the Brazilian Real against the US Dollar and weakening of the Euro against several other currencies have positively affected operating income. Transaction effects amounted to approximately SEK 400m. Results from hedging contracts had a positive impact of approximately SEK 75m on operating income, compared to the previous year.

Compared to the previous year, translation of income statements in subsidiaries had a negative impact on operating income of approximately SEK –325m, mainly due to the weakening of the Euro and the US Dollar against the Swedish krona.

For additional information on effects of changes in exchange rates, see section on foreign exchange risk in Note 2.

Market overview

The overall European market for appliances was unchanged over the previous year. Demand in Western Europe declined by 3% and declined in for Electrolux important markets in Southern Europe. Demand in Eastern Europe increased by 9%. Demand in the North American market declined by 4%. The market in Brazil increased and most other markets in Latin America also improved.

Demand for appliances in Europe in 2012 is expected to be flat or decline by up to two percent. Demand for appliances in North America is expected to be flat or increase by up to two percent.