Net sales and income

- Organic sales growth was 4.5%, while currencies had a negative impact of -5.3%.

- Operating income amounted to SEK 4,055m (5,032), corresponding to a margin of 3.7% (4.6), excluding items affecting comparability.

- Measures to reduce costs were initiated, and SEK 2,475m was charged to operating income within items affecting comparability.

- Negative impact from currencies by SEK -1,460m.

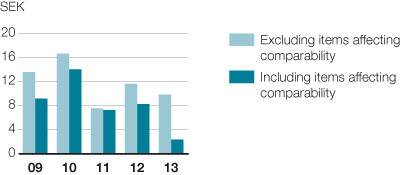

- Income for the period was SEK 672m (2,365) and earnings per share amounted to SEK 2.35 (8.26).

Net sales

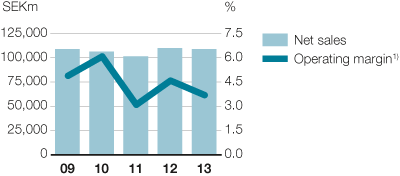

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.

Strong sales growth was seen in Asia/Pacific, North America and Latin America. 2013 was a year with extensive launches of new products across most markets.

Net sales and operating margin

Operating income

Operating income for 2013 decreased to SEK 1,580m (4,000), corresponding to a margin of 1.4% (3.6).

In 2013, measures were initiated to improve manufacturing footprint and reduce costs, particularly in Europe. A total of SEK -2,475m was charged to operating income within items affecting comparability, see page 96.

Operating income for 2013, excluding items affecting comparability, decreased to SEK 4,055m (5,032), corresponding to a margin of 3.7% (4.6).

Major Appliances North America showed a positive earnings trend during the year, while price pressure and weak volumes in Europe had a negative impact on operating income for Major Appliances Europe, Middle East and Africa. Unfavorable currency movements had a negative impact on operating income for the operations in emerging markets, in Europe and in Australia.

Increased investments and marketing spend related to new product launches particularly in Asia/Pacific also impacted operating income for 2013.

Cost savings and the ongoing global initiatives to reduce complexity and improve competitiveness within manufacturing made a contribution to operating income as well as an improved product mix.

Effects of changes in exchange rates

Changes in exchange rates had a negative impact year-over-year on operating income of SEK -1,460m. The impact of transaction effects was SEK -1,548m, results from hedging operations SEK 383m and translation effects SEK -295m. Operations in Latin America, Asia/Pacific, Europe, Middle East and Africa were impacted by a stronger US dollar and euro against local currencies.

The weakening of several currencies in emerging markets had an adverse impact on operating income.

Financial net

Net financial items decreased to SEK -676m (-846).

Income after financial items

Income after financial items decreased to SEK 904m (3,154), corresponding to 0.8% (2.9) of net sales.

Taxes

Total taxes in 2013 amounted to SEK -232m (-789), corresponding to a tax rate of 25.7% (25.0)

Income for the period and earnings per share

Income for the period amounted to SEK 672m (2,365), corresponding to SEK 2.35 (8.26) in earnings per share before dilution and SEK 9.81 (11.36), excluding items affecting comparability.

Earnings per share

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.