Europe, Middle East and Africa

Major Appliances

Electrolux commands significant market shares for major appliances in Europe, Middle East and Africa. Following several years of extensive product launches, the Group has a competitive offering in all segments in the European market. The priority is to further strengthen the position in core markets by focusing on the most profitable product categories, brands and sales channels, and to expand in growth markets in the Middle East and Africa.

Jonas Samuelson

Head of Major Appliances Europe, Middle East and Africa

|

Share of net sales 2013 |

Share of operating income |

|---|---|

| 31% | 9% |

Market position

- Core Appliances 17% in Western Europe

- Core Appliances 13% in Eastern Europe

- A leading position in markets in North Africa and the Middle East

In Western Euroope, which is the Groups’s largest market, Electrolux has a broad, competitive offering under the three main brands, Electrolux, AEG and Zanussi, and has significant market shares in many countries and segments, with a particularly strong position in kitchen appliances, such as cookers, hobs and built-in products. Demand for appliances has, however, been in decline for several years in Western Europe. This trend persisted in 2013 as a result of the weak economic climate. For some time now, the market has been characterized by overcapacity and price pressure. One of the reasons for this is that it is a fragmented market with a large number of manufacturers, brands and retailers.

Growth and innovation

Despite the continued weak performance of the market, there are several examples of growing segments in which Electrolux holds a strong position. These include built-in appliances, energy-efficient appliances and products marketed under retailers’ own brands, such as IKEA. The built-in segment continued to grow during the year and the Group captured market shares.

Following extensive launches in 2012 of entirely new product ranges under all of the main brands, activities continued in 2013 with the launch of the Electrolux Inspiration Range. The product range has now been launched across all markets in Europe. In 2013, a new product series, the Electrolux Gourmet Range, was launched. This range is positioned between the ultra-luxury Electrolux Grand Cuisine, professional cooking system for home use, and the Electrolux Inspiration Range in the premium segment. New steam ovens for sous-vide cooking within the built-in premium segment under the Electrolux and AEG brands were also launched in 2013.

In the induction hobs segment, Electrolux commands a very strong position with growth potential; as penetration for this product group remains low in both Western and Eastern Europe. An increasing number of Eastern European households are able to afford to replace old appliances and invest in new, more exclusive kitchen products.

Africa and the Middle East comprise a large number of countries with significant variation in terms of wealth and degree of urbanization. However, a common theme is that demand for appliances, primarily refrigerators, cookers, washing machines and air-conditioning equipment, rises in parallel with growing prosperity. The ongoing integration of Egyptian Olympic Group has considerably strengthened the Group’s position in the Middle East and North Africa. By the end of 2013, the Zanussi brand was re-launched in Egypt with a complete portfolio of products covering kitchen products and washing machines.

Operational excellence

Structural actions have been in progress for a number of years in the European operations to reduce complexity and enhance efficiency. A central part of this program is to further streamline and focus operations on the most profitable product categories, brands and sales channels. This involves a review of the number of product variants and brands. As a consequence of the weak market conditions in Europe, further actions were launched in 2013. Activities also continued to further boost manufacturing competitiveness. A study was initiated during the year to review the Group’s production structure for appliances in Italy.

Net sales and operating margin 2013

Priorities moving forward

- Greater focus on strong brands and product ranges

- Reduced complexity in operations

- Enhanced manufacturing competitiveness

Market demand for 2013 compared to 2012

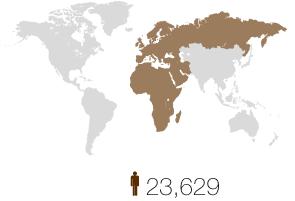

Electrolux markets and average number of employees 2013

Product highlights

Gourmet Range

The Electrolux Gourmet Range is a very exclusive collection of built-in appliances and was launched together with kitchens from Poggenpohl. The new products are sold exclusively via kitchen manufacturers. The range has been tested by professional chefs to meet their exacting standards and includes Sous-vide capability through a vacuum sealing drawer and combi-steam ovens that offer precision temperature settings to the nearest degree; wine cooler; and teppanyaki hob.

Sous-vide oven and vacuum sealer

The innovative CombiSteam Sous-vide oven and vacuum sealer was launched in Europe under the Electrolux and AEG brands. Sous-vide is an example of Electrolux professional technology being introduced in a premium domestic product. It is aimed at foodies – people who are genuinely passionate about cooking.

Air conditioners

A range of air conditioners was launched in the European market during 2013. This product category has a strong growth potential in Europe, the Middle East and in Africa.

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.