The financial goals of Electrolux are intended to enable the generation of added shareholder value. In addition to maintaining and strengthening the Group’s leading global position in the industry, achieving these goals contributes to generating a healthy total return for shareholders. The extensive restructuring program carried out in the Group and an improved mix has led to a higher operating margin and return, thus creating better prerequisites for profitable growth in future years.

| >6% | OPERATING MARGIN |

| >4% | CAPITAL TURNOVER RATE |

| >25% | RETURN ON NET ASSETS |

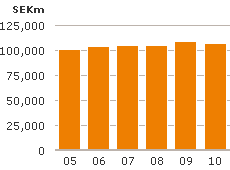

| >4% | GROWTH |

Operating margin of at least 6% over a business cycle

Efforts to transform Electrolux into an innovative, consumer-focused company have yielded results. Electrolux is now one of the strongest companies in the appliance industry in terms of market share, brand recognition and profitability. In 2010, Electrolux succeeded in achieving an operating margin of 6,1%, excluding items affecting comparability, primarily through lower costs and an improved product mix. By maintaining its focus on innovative products, a strong brand in the premium segment and competitive production, Electrolux has achieved its current level of profitability despite weak markets in the west and an industry that continues to be characterized by overcapacity and price pressure. Over the past two years, average Group utilization of production capacity was about 60% compared with the normal level of about 85%.

Electrolux operating margin will continue to fluctuate due to general economic conditions and trends in the household appliance market. Electrolux specifies an average goal for its operating margin measured over the current business cycle.

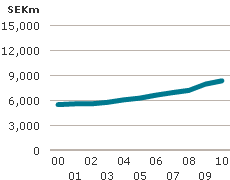

Capital-turnover rate of at least four

Electrolux strives for an optimal capital structure in relation to the Group’s goals for profitability and growth. Extensive investment has been made in new, modern production facilities in low-cost areas, and production has been discontinued in high-cost areas.

In recent years, work on reducing working capital has been intensified. This has involved reviewing all aspects from supplier contracts and inventory management to invoicing of customers. It has resulted in a lower level of structural working capital, that is, the share of capital that is not affected by changes in business conditions, as well as a stronger cash flow. When demand and sales accelerate again, even greater focus will be required on limiting the degree of capital intensity within the Group through, for example, more efficient outsourcing of products and components. Reducing the amount of capital tied up in operations creates opportunities for rapid and profitable growth.

The capital-turnover rate amounted to 5.1 during 2010, which surpassed the goal.

Return on net assets of at least 25%

Focusing on growth with sustained profitability and a small but effective capital base enables Electrolux to achieve a high long-term return on capital. With an operating margin in excess of 6% and a capital-turnover rate of at least 4, Electrolux achieves a return on net assets (RONA) of at least 25%. The figure reported for 2010 was 31%, which exceeded the goal.

Average growth of at least 4% annually

Electrolux has undergone an important and extensive transformation of operations, which has led to increased profitability. When combined with a strong, global brand in the premium segment and a rapid and efficient process for developing innovative products, this enables Electrolux to place its long-term focus on profitable growth.

The long-term drivers in the market for household appliances stand firm; households replace their existing appliances with new ones, they renovate their homes, and build new ones, and penetration increases, particularly in growth markets. Over the course of a business cycle, growth is in line with the average for the global economy, which is approximately 3–4%.

In order to achieve higher growth than the market average, the Group continues to strengthen its positions in the premium segment, expand in profitable high-growth product categories, increase sales in growth regions and develop service and aftermarket operations.

In addition to organic growth, opportunities exist for implementing the Group’s growth strategy more rapidly, through acquisitions or the establishment of business partnerships. Electrolux seeks to acquire operations that have complementary technology or geographical coverage, well-positioned products, and strong brands. This will enable Electrolux to increase market shares in high-price segments and in growth markets. In 2010, Electrolux acquired a washing-machine plant in the Ukraine and entered a preliminary agreement to acquire the Egyptian appliance manufacturer Olympic Group. These acquisitions will strengthen the position of Electrolux in the growth markets of Eastern Europe, North Africa and the Middle East. Given the recent events in Egypt, things will be put on hold until stability in the country resumes.