- Net sales increased by 1.5% in comparable currencies.

- Strong growth in Latin America and Asia/Pacific offset lower sales volumes in Europe and North America.

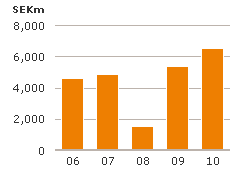

- For the first time Electrolux achieved its operating margin target of 6%.

- Operating income increased to SEK 6,494m (5,322), corresponding to an operating margin of 6.1% (4.9), excluding items affecting comparability.

- Improvements in product mix and cost savings offset higher costs for raw materials and downward pressure on prices.

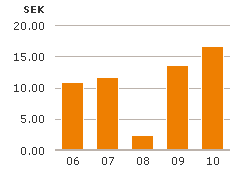

- The Board of Directors proposes a dividend for 2010 of SEK 6.50 (4.00) per share.

| Key data | ||||

| SEKm, EURm, USDm, unless otherwise stated | 2010 | 2009 | 2010 EURm | 2010 USDm |

| Net sales | 106,326 | 109,132 | 11,125 | 14,763 |

| Operating income | 5,430 | 3,761 | 568 | 754 |

| Margin, % | 5.1 | 3.4 | ||

| Income after financial items | 5,306 | 3,484 | 555 | 737 |

| Income for the period | 3,997 | 2,607 | 418 | 555 |

| Earnings per share, SEK, EUR, USD | 14.04 | 9.18 | 1.47 | 1.95 |

| Dividend per share | 6.501) | 4.00 | ||

| Average number of employees | 51,544 | 50,633 | ||

| Net debt/equity ratio | –0.03 | 0.04 | ||

| Return on equity, % | 20.6 | 14.9 | ||

| Excluding items affecting comparability | ||||

| Items affecting comparability | –1,064 | –1,561 | –111 | –148 |

| Operating income | 6,494 | 5,322 | 679 | 902 |

| Margin, % | 6.1 | 4.9 | ||

| Income after financial items | 6,370 | 5,045 | 666 | 884 |

| Income for the period | 4,739 | 3,851 | 496 | 658 |

| Earnings per share, SEK | 16.65 | 13.56 | 1.74 | 2.31 |

| Return on net assets, % | 31.0 | 26.2 | ||

| 1) Proposed by the Board of Directors. |

| Net sales and employees | ||

| Ten largest countries | SEKm | Employees |

| USA | 29,782 | 8,675 |

| Brazil | 14,231 | 11,004 |

| Germany | 5,974 | 1,783 |

| Australia | 5,514 | 1,580 |

| Italy | 4,609 | 6,210 |

| Canada | 4,390 | 1,401 |

| France | 4,223 | 1,182 |

| Switzerland | 3,667 | 875 |

| Sweden | 3,353 | 2,296 |

| United Kingdom | 2,898 | 387 |

| Other | 27,685 | 16,151 |

| Total | 106,326 | 51,544 |