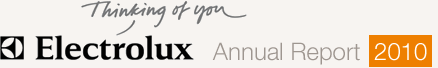

- Demand in most of the key markets increased in 2010.

- The North American market increased by 5% and the European market by 2%.

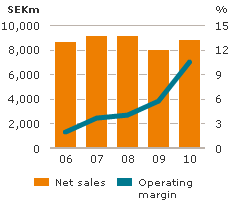

- Net sales increased by 1.5% in comparable currencies.

- Sales were impacted by mix improvements and increased volumes.

- All business areas outperformed previous year’s results.

- Strong improvements in operating income for the operations in Asia/Pacific and for Professional Products.

- Improvements in product mix and cost savings offset higher costs for raw materials and downward pressure on prices.

- Average number of employees increased to 51,544 (50,633).

The Group’s operations include products for consumers as well as professional users. Products for consumers comprise major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens, as well as floor-care products. Professional products comprise food-service equipment for hotels, restaurants and institutions, as well as laundry equipment for apartment-house laundry rooms, launderettes, hotels and other professional users.

In 2010, appliances accounted for 86% (85) of sales, professional products for 6% (7) and floor-care products for 8% (8).

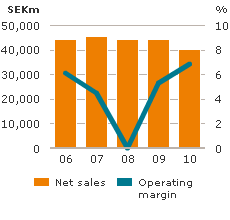

Consumer Durables, Europe, Middle East and Africa

Core appliances

Total demand in the European market stabilized in 2010 and increased by 2%, after more than two years of decline. Demand in Western Europe increased by 1% and demand in Eastern Europe. by 6%.

Group sales decreased in 2010, on the basis of lower volumes and lower prices in the market. Sales volumes have been impacted by the fact that the German retailer Quelle, one of the Group’s largest customers, declared bankruptcy at the end of 2009.

Operating income improved considerably compared to the previous year, above all due to a positive mix development. Increased sales of built-in products, primarily in the German market, and a higher proportion of sales stemming from the central regions of Europe contributed to an improved product mix. In addition, lower warranty costs had a positive impact on operating income.

Previous employee cutbacks and cost-saving measures continued to positively impact operating income, while lower volumes, price pressure and higher marketing and brand investments had a negative impact.

Floor-care products

Market demand for vacuum cleaners in Europe increased in 2010, compared to 2009.

Group sales increased and operating income improved substantially. This is a result of increased sales of products in the premium segment, which improved the product mix.

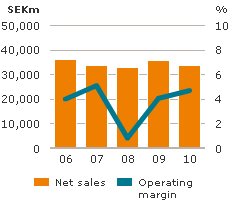

Consumer Durables, North America

Core appliances

Market demand for core appliances in North America increased by 5% in 2010, compared to the previous year. The growth derives from a very low level after more than three years of decline. One contributing factor to the growth in 2010 was the state-sponsored rebate program for energy-efficient products in the second quarter.

Group sales in 2010 were in line with the previous year. Operating income increased primarily on the basis of an improved product mix. Since the end of 2009, Electrolux has been terminating certain sales contracts under private labels that have poor profitability. This has positively impacted the product mix.

Floor-care products

Demand for vacuum cleaners in North America increased in 2010 in comparison with the previous year. Group sales declined on the basis of lower sales volumes and price pressure in the market.

Operating income declined, due to lower sales volumes, higher costs for sourced products and lower prices in the market.

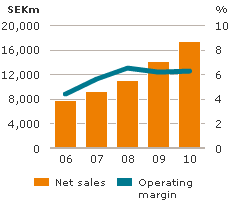

Consumer Durables, Latin America

Market demand for appliances in Brazil increased in 2010 compared to the previous year. Several other markets in Latin America also showed good growth.

Electrolux sales volumes in Latin America increased in 2010, which led to higher sales and increased market shares for the Group in Brazil and several other markets in Latin America. The remaining markets in Latin America accounted for 17% of all Group sales in Latin America.

Operating income for 2010 improved, primarily on the basis of higher volumes and an improved product mix. The launch of new products and increased sales of air-conditioning equipment have contributed to a better product mix. For the third consecutive year, operating income was the best ever for the operations in Latin America.

The Group’s floor-care operations in Latin America showed good growth and profitability development in the year.

Consumer Durables, Asia/Pacific

Australia and New Zealand

Market demand for appliances in Australia declined during 2010, compared to the previous year. Group sales declined somewhat.

Operating income improved considerably, on the basis of changes in exchange rates and improved cost efficiency. Increased costs for raw materials and price pressure in the market, however, had a negative impact on operating income.

Southeast Asia and China

Market demand in Southeast Asia and China increased in 2010, compared to the previous year.

Electrolux sales in the Southeast Asian and Chinese markets grew substantially, by approximately 35%, during the year, and the Group continued to gain market shares. The operations in Southeast Asia continued to show good profitability.

Professional Products

Market demand for food-service equipment stabilized in 2010, compared to the previous year. Sales volumes of the Group’s own products have increased. However, total sales of food-service equipment declined. This is because the Group in the third quarter of 2010 exited a contractor of larger kitchen products in North America because of less profitability.

Operating income showed a considerable improvement thanks to increased sales of Group-manufactured products, an improved customer mix and cost efficiencies.

Market demand for professional laundry products is estimated to have stabilized in 2010. The Group’s sales volumes decreased. Operating income, however, improved due to price increases and increased cost efficiency.

Operating income for 2010 was the best ever for the operations in Professional Products.

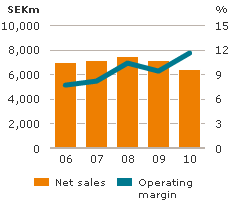

Operating income and margin per quarter for the Group

Operating income in the fourth quarter of 2008 was adversely impacted by cost-reduction measures in the amount of SEK –1,045m.