Ownership structure

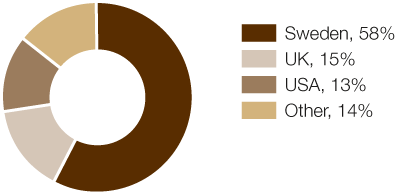

The majority of the total share capital as of December 31, 2013, was owned by Swedish institutions, mutual funds and private investors amounting to 58%. During the year, the proportion of the capital held by foreign owners increased and amounted to approximately 42% (41%) at the end of the year. The volume of shares traded by foreign owners has a significant effect on share liquidity. Foreign investors are not always recorded in the share register as foreign banks and other custodians may be registered for one or several customers’ shares, why the actual owners are then usually not displayed in the register.

Major shareholders

|

|

Share capital, % |

Voting rights, % |

|---|---|---|

| Investor AB | 15.5 | 29.9 |

| Alecta Pension and Insurance | 3.9 | 4.3 |

| Swedbank Robur funds | 3.3 | 2.7 |

| AMF Insurance & Funds | 2.7 | 2.2 |

| Government of Norway | 2.2 | 1.7 |

| Didner & Gerge Funds | 1.7 | 1.4 |

| SHB Funds | 1.2 | 1.0 |

| Second Swedish National Pension Fund | 1.1 | 0.8 |

| Unionen | 1.0 | 0.8 |

| SEB funds | 0.9 | 0.8 |

| First Swedish National Pension Fund | 0.9 | 0.7 |

| Other shareholders | 58.2 | 53.7 |

| External shareholders | 92.6 | 100.0 |

| AB Electrolux | 7.4 | 0.0 |

| Total | 100.0 | 100.0 |

Shareholders by country

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.