Exchange-rate exposure at Electrolux

Exchange-rate exposure

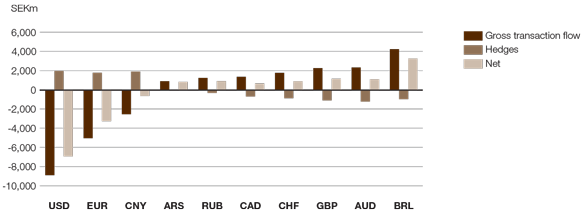

The global presence of Electrolux, with manufacturing and sales in a number of countries, offsets exchange-rate effects to a certain degree. The principal exchange-rate effect arises from transaction flows; when purchasing and/or production are/is carried out in one currency and sales occur in another currency. The Group utilizes currency derivatives to hedge a portion of the currency exposure that arises. The business areas within Electrolux usually have a hedging horizon of between three and eight months of forecast flows. Hedging horizons outside this period are subject to approval from Group Treasury. It is mainly business areas in emerging markets that have a shorter hedging horizon. The business areas are permitted to hedge forecast flows from 60% to 80%. The usual effect of currency hedging is that currency movements that occur today have, to a certain degree, a delayed effect. Electrolux is also affected by translation effects when the Group’s sales and operating income are translated into SEK. The translation exposure is primarily related to currencies in those regions where the Group’s most substantial operations exist, that is, EUR and USD.

Sensitivity analysis of currencies

The major currencies for the Electrolux Group are the USD, EUR, BRL, RUB, AUD and GBP. The key currency pairs are presented in the map together with an explanation of how they impact the Group. In general, income for Electrolux benefits from a weak USD and EUR and from a strong BRL, RUB, AUD and GBP.

Currency effects 2013

Compared with the previous year, changes in exchange rates for full-year 2013 had a negative impact on operating income. The total currency effect (translation effects, transaction effects and net hedges) amounted to approximately SEK –1,460m. The net transaction effect was SEK –1,164m, results from hedging operations SEK 383m and translation effects SEK –295m.

The impact from transaction and hedging operations was mainly attributable to the operations in Latin America and the strengthening of the USD against the BRL. The weakening of several currencies in emerging markets also impacted operations in Asia/Pacific and Europe, the Middle East and Africa.

Principal currency pairs Electrolux (transaction effects)

North America

The principal currency pairs for the North American operations are the USD/CAD and MXN/USD. A significant portion of production is conducted in Mexico and the products are subsequently sold in USD. Accordingly, a weak MXN compared with the USD is positive for the Group. A strong CAD compared with the USD is positive for the Group, since a large portion of the costs for the Canadian products is expensed in USD (purchasing and production costs).

Latin America

The principal currency pair for the Latin American operations is the USD/BRL. Purchases of raw materials and components are to a large extent priced in USD. The products are then sold in BRL. A weak BRL compared with the USD is negative for the Group.

Europe

The principal currency in Europe is the EUR. A weak EUR has a positive net effect on Group income, because European operations have greater expenses in EUR than sales in EUR. A majority of the purchases of raw materials and components is denominated in EUR, as are significant production costs.

Asia/Pacific

The principal currency pairs for the business in the Asia/Pacific region is the USD/AUD and CNY/USD. Purchases of raw materials and components are to a certain extent priced in USD and the products are subsequently sold in AUD. A strong AUD compared with the USD is positive for the Group. Some purchases from China are denominated in CNY and sold in USD. Accordingly, a weak CNY vs USD has a positive effect on the Group.

Main translation effects: USD/SEK, EUR/SEK

Foreign-exchange transaction exposure, forecast 2014

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.