Frequently asked questions by analysts

Analysts’ questions at 2013 quarterly telephone conferences

Describe the competitive landscape in the market place developed in 2013 and its impact on Electrolux?

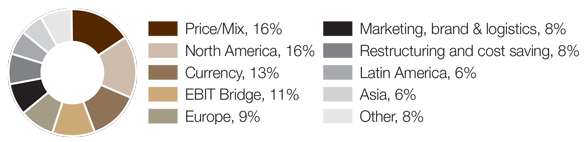

Price pressure continued to be evident in the European market in 2013 while the markets in North America and Latin America characterized a more stable pricing environment. In 2013, Electrolux continued to improve its price-mix in North America and successfully implemented price increases in Latin America.

How did Electrolux mix develop over the year and what has been the main driver of that?

Improving our mix through product launches and diligent price and product management is central in our strategy and to our growth ambitions while we offer more value to our customers. We are increasing the sales share of premium and built-in appliances which helps improve the mix and contribute to profitability. 2013 has been a year of intensive product launches in which we completed the launch of the Electrolux-branded premium brands across Europe and in other core markets. This has helped improve our product mix in most markets.

Could you update us on the market in North America and how your performance has been there?

The North American appliance market showed strong growth and increased by 9% in 2013. Consumer confidence has improved and we have also seen housing statistics improving. During the year, Electrolux continued to strengthen its position in the main market channels and have gained market shares. Earnings in North America increased significantly versus previous year.

How did your currency exposures affect your earnings?

Electrolux has approximately SEK 45 billion of currency in and outflow every year. This leads to a high exposure to currency risks as the Group operates in over 150 countries. In 2013, many important currency pairs showed large fluctuations which affected the Group’s operating income. About one-third of the negative impact was from Latin American currencies, which depreciated heavily against the US Dollar. The total negative impact from both currency transaction and translation to Electrolux earnings was SEK –1,460 million.

How will you restore earnings in Europe?

The European market followed the weak trend from last year and declined by 1% in 2013. Increased competition and price pressure have resulted in falling profits for many players in Europe. In response to the challenging market environment, we have taken initiatives to reduce our cost base, improve our competitiveness within manufacturing and focus on increased product mix.

What investment costs did you have for marketing, branding and logistics?

As part of Electrolux growth ambitions and to meet the market demand, the Group is accelerating its product innovation and launches across all major markets. In North America, investments related to the new cooking plant in Memphis, Tennessee, and ramp-up costs for new channel expansion were continued. In Europe, the launch of the Electrolux branded Inspiration Range was completed. The biggest launch in 2013 was made in China, with more than 60 new products for kitchen and laundry.

Can you provide us with an update on your restructuring and cost savings programs?

Electrolux has been implementing an extensive restructuring program since 2004. Plants have been closed in high-cost areas, including the US, Germany and Australia, and new plants have been built in Mexico, Eastern Europe and Thailand. In 2013, additional measures were presented to further adapt capacity in mature markets to lower demand. Savings have been estimated to SEK 1.8 billion with full effect from 2016 and total cost to approximately SEK 3.4 billion of which SEK 1.5 billion was charged to operating income in 2013.

StopSearchHereCEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.