Managing risks

2013 was characterized by yet another year of uncertainty in the market environment and increased fluctuations in currencies. Electrolux monitors and manages its exposure to various types of risks in a structured and proactive manner.

Electrolux monitors and minimizes key risks in a structured and proactive manner. Capacity has been adjusted in response to weak demand, working capital has undergone structural improvements, the focus on price has intensified and the purchasing process for raw materials has been further streamlined. The major risks and the Group’s response in order to manage and minimize them are described below.

Understanding Electrolux cost structure, 2013

| SEKbn |

|

|---|---|

| Revenues | 109 |

| Direct material | –45 |

| Sourced products | –17 |

| Salaries and other expenses | –43 |

| Operating earnings | 4 |

| Variable cost to sales | 80% |

| Fixed cost to sales | 16% |

| Operating earnings to sales | 4% |

Operational risks

The Group’s ability to improve profitability and increase shareholder return is based on three elements: innovative products, strong brands and cost-efficient operations. Realizing this potential requires effective and controlled risk management.

Fluctuation in demand

In 2013, demand for appliances in the North American market showed strong growth and increased by 9%. In Europe, demand continued to be weak as Western Europe declined by 1%, while it was flat in Eastern Europe. In Latin America, growth slowed down driven by Brazil where demand declined by 8% during the year. In the Asia/Pacific region, demand in Australia showed signs of recovery, while the Asian markets continued to grow healthily.

Weak demand in Europe resulted in Electrolux operations being run at an average of 60% capacity. Decisive actions and savings packages throughout the Group have proven that Electrolux can quickly adjust its cost structure when demand for the Group’s products declines.

Price competition

A number of the markets served by Electrolux are experiencing strong price competition. This is particularly severe in the low-cost segments and in product categories with a great deal of overcapacity. In 2013, pressure on prices continued to be evident in some of the Group’s major markets. Sales promotions continued in the North American market, at the same time as prices continued to deteriorate in Europe during the year. In Latin America, higher inflation combined with currency fluctuations resulted in Electrolux carrying out several price increases to offset the negative effect. Price pressure in Australia softened towards the end of the year.

Exposure to customers and suppliers

The weak trend in some of Electrolux major markets in 2013 impacted the Group’s customers, who experienced difficult trading conditions, but this did not result in any major increases in credit losses for Electrolux.

Electrolux has a comprehensive process for evaluating credits and monitoring the financial situation of customers. Authority for approving and responsibility to manage credit limits are regulated by the Group’s credit policy. A global credit insurance program is in place for many countries to reduce credit risk.

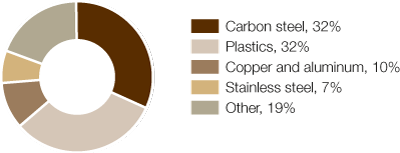

Raw materials and components represent the largest cost item

Materials account for a large share of the Group’s costs. In 2013, Electrolux purchased raw materials and components for approximately SEK 44 billion, of which approximately SEK 19 billion referred to the former. The Group’s exposure to raw materials comprises mainly steel, plastics, copper and aluminum.

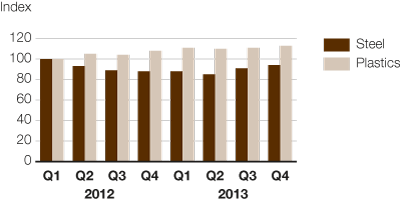

Market prices for raw material remained stable in the first half of the year, but was at a somewhat higher level towards the end of the year. Electrolux utilizes bilateral contracts to manage risks related to steel prices. Some raw materials are purchased at market prices. The total cost of raw materials in 2013 was somewhat lower than in 2012.

Sensitivity analysis year-end 2013

| Risk | Change | Pre-tax earnings impact, SEKm |

|---|---|---|

| Raw materials |

|

|

| Steel | 10% | +/– 700 |

| Plastics | 10% | +/– 600 |

| Currencies¹) and interest rates |

|

|

| USD/SEK | –10% | +772 |

| EUR/SEK | –10% | +350 |

| BRL/SEK | –10% | –456 |

| AUD/SEK | –10% | –263 |

| GBP/SEK | –10% | –231 |

| Interest rate | 1 percentage point | +/– 70 |

Raw material exposure 2013

Trend for steel and plastics prices, weighted market prices indexed

Restructuring for competitive production

A large share of the Group’s production has been moved from high-cost to low-cost areas. Restructuring is a complex process that requires managing a number of different activities and risks. Increased costs related to relocation of production can affect income in specific quarters. When relocating, Electrolux is also dependent on the capacity of suppliers for cost-efficient delivery of components and semi-finished goods.

In 2013, additional measures were presented to further adapt capacity and reduce overhead costs in mature markets to a lower demand. Annual savings were estimated to approximately SEK 1.8 billion as of 2016.

Financial risks and commitments

The Group’s financial risks are regulated in accordance with the financial policy that has been adopted by the Electrolux Board of Directors. Management of these risks is centralized to Group Treasury and is mainly based on financial instruments. Additional details regarding accounting principles, risk management and risk exposure are given in Notes 1, 2 and 18.

Financing risk and interest-rate risks

For long-term borrowings, the Group’s goal is to have an average maturity of at least two years, an even spread of maturities and an average fixed-interest period of one to three year. At year-end 2013, Group borrowings amounted to SEK 14,905m, of which SEK 11,935m referred to long-term loans with an average maturity of 3.3 years. Loans are raised primarily in USD, EUR and SEK. The average interest rate at year-end for the total borrowings was 3.2%. At year-end 2013, the average fixed-interest period for long-term borrowings was 1.0 years. Long-term loans with maturities within 12 months amount to SEK 272m. Liquid funds on December 31, 2013, amounted to SEK 7,232m.

In addition, the Group has two unutilized credit facilities. Since 2010, Electrolux has an unused committed multicurrency revolving credit facility of SEK 3,400m maturing in 2017 as well as an unused multicurrency revolving credit facility of EUR 500m maturing in 2018. These two facilities can be used as either long-term or short-term back-up facilities.

On the basis of the volume of loans and the interest-rate periods in 2013, a change of 1 percentage point in interest rates would affect Group income in the amount of +/– SEK 70m. For additional information on loans, see Notes 2 and 18.

Pension commitments

At year-end 2013, Electrolux had commitments for pensions and benefits that amounted to approximately SEK 23 billion. Through pension funds, the Group manages pension assets of approximately SEK 20 billion. At year-end, approximately 35% of these assets were invested in equities, 42% in bonds, and 23% in other assets. Net provisions for post-employment benefits amounted to SEK 3,425m.

Yearly changes in the value of assets and commitments depend primarily on developments in the interest-rate market and on stock exchanges. Other factors that affect pension commitments include revised assumptions regarding average life expectancy and healthcare costs.

Costs for pensions and benefits are recognized in the income statement for 2013 in the amount of SEK 727m. In the interest of accurate control and cost-effective management, the Group’s pension commitments are managed centrally by Group Treasury. Electrolux uses interest-rate derivatives to hedge parts of the risks related to pensions. For additional information, see Note 22.

StopSearchHereCEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.