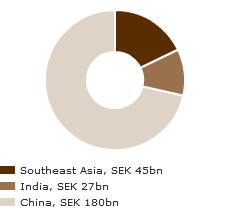

With a growing range of innovative products adapted to the specific needs of households, Electrolux sales are continuing to display a strong trend in Southeast Asia and China. Focus is directed to appliances and vacuum cleaners in the premium segment under the Electrolux brand.

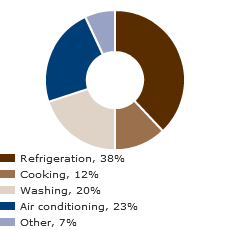

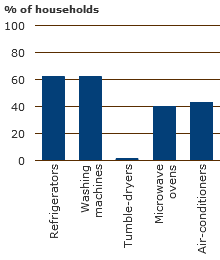

China is the largest market for household appliances in the world, measured by volume. Demand for appliances and vacuum cleaners has been driven by high growth in the country combined with fast-paced urbanization, with a rapidly emerging middle class demanding premium products. Households are often small with limited space to accommodate appliances. Small living spaces also dominate in Southeast Asia, a region undergoing rapid urbanization and population growth. Many households are not equipped with a cooker, but use other alternatives to cook food, such as rice cookers and gas burners. Similar to other growth markets, consumers prioritize refrigerators, washing machines and air-conditioning equipment as prosperity rises. In 2012, demand for appliances continued to rise sharply in Southeast Asia, while it declined slightly in China.

Major players in China

Domestic appliance manufacturers Haier Group and Midea dominate in China, particularly in the lower-price segments. Foreign manufacturers hold only small market shares, although they are growing fast in the premium segment. There is no clear market leader in the Southeast Asian countries, but similar to China, many consumers choose European brands in the upper-price segments. The retailer network in China has undergone significant consolidation. Domestic retail chains Gome and Suning account for a substantial portion of sales of household appliances. Asian consumers often make purchasing decisions in stores. Accordingly, it is essential to have an effective sales and marketing organization that ensures that consumers receive correct advice and a high level of service in stores.

A priority area for growth

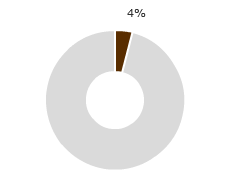

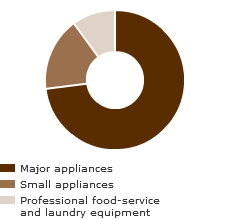

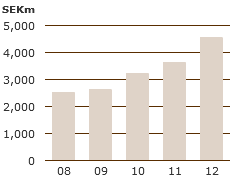

Electrolux is a reputable brand in Southeast Asia and commands a strong position in the upper-price segments. The Group is a market leader in front-load washing machines and is rapidly expanding the offering in products for the kitchen. In China, Electrolux is focusing on the rapidly growing middle class in major cities. Products are sold through the largest retailers. Sales rose by more than 30% in 2012, as a result of such factors as successful product launches. A strong service network and proprietary manufacturing in the region have contributed to the rapid increase in sales of the Group’s professional food-service and laundry products in Southeast Asia.

Growth opportunities

Growing awareness among consumers in the region regarding various environmental challenges is contributing to higher demand for energy and water-efficient products, such as compact and resource-efficient front-load washing machines. In Southeast Asia, the market for small, compact vacuum cleaners and small domestic appliances is also growing very quickly.

Product penetration in

Source: Electrolux estimates. |

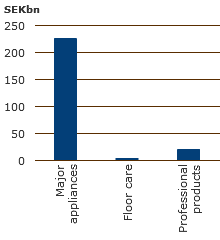

Market value

Source: Electrolux estimates. |