The majority of Australians live on the East Coast and both the population and the number of households are on the rise. The degree of penetration is high in most product categories and demand is driven primarily by interest in design, innovation and the environment. In 2012, the market remained characterized by price pressure brought on by a strong Australian dollar, making imported products increasingly competitive. Japan is the world's third-largest single market for household appliances. Growth is driven by such factors as innovations developed for small living spaces.

Consolidated markets

In Australia, competition between manufacturers of appliances from Asia and Europe is intense. Electrolux is the largest company followed by Fischer & Paykel and South Korean companies Samsung and LG Electronics. The retailer market is dominated by five major chains representing 90% of the market. Large, domestic manufacturers and retailers such as Hitachi and Panasonic dominate the Japanese appliance market.

Leading position in Australia

In Australia, the Electrolux brand holds a strong position in the premium price segment for appliances with a focus on innovation, water and energy efficiency, and design. In addition, the Group's Westinghouse and Simpson brands hold significant market shares in the mass-market segment. The Kelvinator brand holds a strong position in air-conditioners and water heaters, which is a new, rapidly growing product category in the Group. A large portion of the best restaurants in Australia is equipped with professional food-service equipment from Electrolux. In New Zealand, Electrolux has captured market shares in vacuum cleaners in recent years, for example, with its green range.

In Japan and South Korea, Electrolux is a relatively small player, but over the past number of years, it has started to establish a rapidly growing business in small, compact vacuum cleaners. Japan is a large and growing market for the Group’s professional products particularly for laundry products.

Growth opportunities

Given the hot and dry climate in Australia, many households prefer to cook food outdoors. In recent years, Electrolux has successfully launched a series of outdoor products, such as the En:tice Barbecue.

Demand in Japan and South Korea is growing for compact, user-friendly and quiet household appliances. Electrolux has positioned itself in the segment with an attractive and leading offering of vacuum cleaners in both countries. The Ergorapido rechargeable, handheld vacuum cleaner was first launched in Japan in 2010. It is now sold in a variety of versions in more than 2,100 stores in Japan.

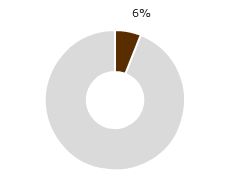

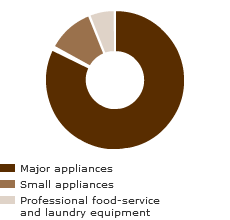

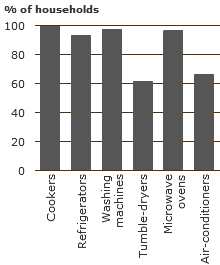

Product penetration in

Source: Electrolux estimates. |

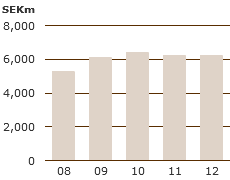

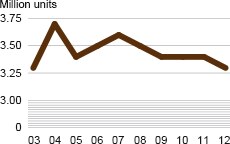

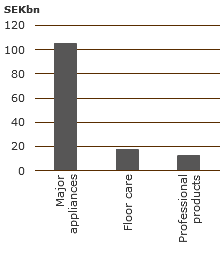

Market value

Source: Electrolux estimates. |