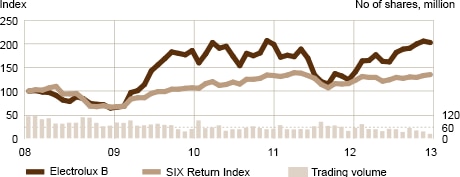

2012 was a strong year for the Electrolux share resulting in a share-price increase of 55%, while the broader Swedish market index, Affärsvärlden General Index, increased by 12% over the same period. The strong price performance was closely linked to consecutive quarters with healthy earnings that met the market expectations of continued growth, profitability and cash-flow generation.

In the second quarter of 2012, Electrolux posted organic growth of 5.8% and gained market share. In the third quarter, the Group was able to maintain growth above its communicated target and deliver an operating margin of 5.4% as a result of improved prices and product launches. These factors contributed to the momentum of the share. The relative performance of Electrolux to the Swedish market index was strong during the year.

Total return

The opening price for the Electrolux B shares in 2012 was SEK 109.70. The lowest closing price was SEK 111.50 on January 9. The highest closing price was SEK 179.00 on December 18. The closing price for the B share at year-end 2012 was SEK 170.50, which was 55% higher than at year-end 2011.

Total shareholder return during the year was 62.7%. Over the past ten years, the average total return on an investment in Electrolux shares has been 15.1% annually. The corresponding figure for the SIX Return Index was 12.6%.

Total return of Electrolux B shares and trading volume on Nasdaq OMX Stockholm, 2008–2012

Share volatility

Over the past three years, the Electrolux share has shown a volatility of 35.7% (daily values), compared with an average volatility of 22.5% for Nasdaq OMX Stockholm. The beta value of the Electrolux B shares over the past five years is 1.16. A beta value of more than 1 indicates that the share’s sensitivity to market fluctuations is above average.

The Electrolux share is listed on Nasdaq OMX Stockholm. The market capitalization of Electrolux at year-end 2012 was approximately SEK 53 billion (34), which corresponded to 1.4% (1.0) of the total value of Nasdaq OMX Stockholm. The company’s outstanding shares are divided into A shares and B shares. A shares entitle the holder to one vote while B shares entitle the holder to 1/10 of a vote.

Dividend

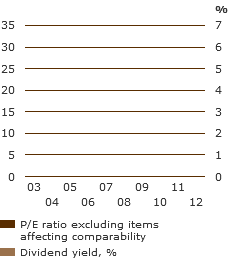

The Board of Directors proposes a dividend for 2012 of SEK 6.50 per share, equivalent to a total dividend payment of approximately SEK 1,860m. The proposed dividend corresponds to approximately 55% of income for the period, excluding items affecting comparability. Based on the share price of Electrolux B shares at the end of 2012, the dividend yield for 2012 amounted to 3.8%.

The Group’s goal is for the dividend to correspond to at least 30% of income for the period, excluding items affecting comparability. For a number of years, the dividend level has been considerably higher than 30%.

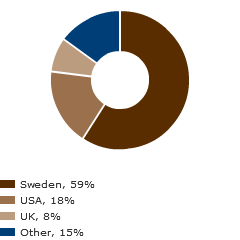

Ownership structure

The majority of the total share capital as of December 31, 2012, was owned by Swedish institutions, mutual funds and private investors amounting to 59%. During the year, the proportion of the capital held by foreign owners increased and amounted to approximately 41% (24%) at the end of the year. The volume of shares traded by foreign owners has a significant effect on share liquidity. Foreign investors are not always recorded in the share register as foreign banks and other custodians may be registered for one or several customers’ shares, why the actual owners are then usually not displayed in the register.

Share-based incentive programs

Electrolux maintains a number of long-term incentive programs for senior management. Since 2004, the Group has three-year performance-based share programs.

At year-end 2012, the incentive programs had an immaterial effect on dilution of the total number of shares.

Conversion of shares

In accordance with the Articles of Association of AB Electrolux, owners of A shares have the right to have such shares converted to B shares. Conversion reduces the total number of votes in the company. In 2012, no shareholder has requested conversion of shares. The total number of registered shares in the company amounts to 308,920,308 shares, of which 8,212,725 are A shares and 300,707,583 are B shares. The total number of votes amounts to 38,283,483.

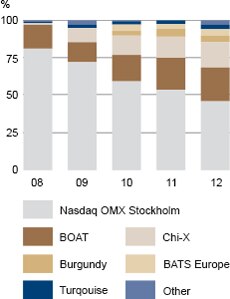

Trading volume

Recently, there has been a clear trend toward new trading venues for shares. During 2012, 54% of Electrolux B shares were traded outside Nasdaq OMX Stockholm, compared with 46% during 2011. In 2012, the Electrolux share accounted for 2.8% (2.5) of the shares traded on Nasdaq OMX Stockholm, of a total trading volume of SEK 2,769 billion (3,684).

DJSI World Index

The Group's sustainability performance and strategy help attract and strengthen relations with investors. In 2012 and for the sixth consecutive year, Electrolux was recognized as a leader in the consumer durables industry sector in the prestigious Dow Jones Sustainability Index (DJSI). Electrolux thereby ranks among the top 10% of the world’s 2,500 largest companies for social and environmental performance. The DJSI index family has approximately 6 billion USD in assets under management. Approximately 55 products are based on the indexes in 15 countries.