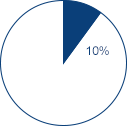

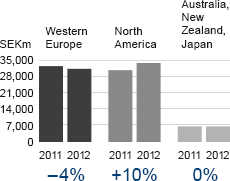

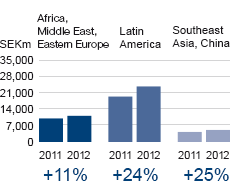

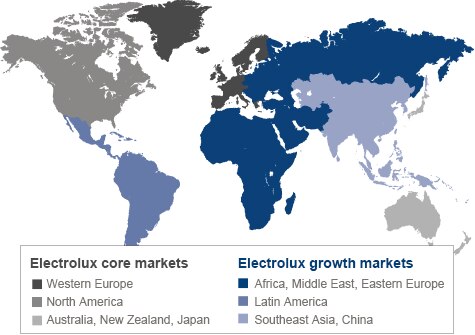

The share of Electrolux sales in growth markets is increasing. In 2012, market demand in Europe and North America declined, while the market trend in such regions as Latin America and Southeast Asia was strong. Electrolux target is to strengthen the position in core markets and increase the share of sales in growth markets to at least 50% within a five-year period.

A slowdown in demand in core markets, combined with the rapid emergence of an affluent middle class in densely populated growth countries, has led to a gradual transformation of the market for household appliances. Adapting the business and offering to this new environment is necessary for Electrolux to continue growing profitably. In 2012, focus was directed to the successful integration of the previously acquired appliance manufacturers Egyptian Olympic Group and Chilean CTI. Furthermore, Electrolux launched a large number of products and solutions adapted to various customer segments and regional demands.

Rising market shares despite fiercer competition

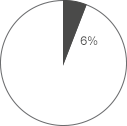

There are fewer, larger and more international manufacturers and retailers in the market for household appliances. The five largest manufacturers of major appliances in the world – Whirlpool, Electrolux, HaierGroup, Bosch-Siemens and LG Electronics – account for almost half of global sales today. In recent years, manufacturers from Asia have increased their market shares in the European, North American and Australian markets. To maintain competitiveness in relation to rapidly expanding manufacturers from low-cost areas, Electrolux will continue to leverage its global and regional economies of scale. Focus is directed to developing innovative products based on consumer insight and under strong brands. Despite the increasingly intense competition, Electrolux captured market shares in North America, Latin America and Southeast Asia in 2012.

Growing demand for core appliances

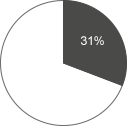

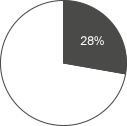

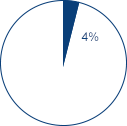

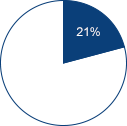

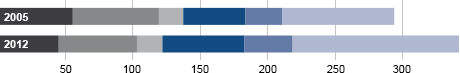

Between 2005 and 2012, the global demand for core appliances increased significantly, mainly due to strong growth in Asia. Demand for core appliances in core markets has simultaneously decreased. In 2012, the demand for core appliances in growth markets constituted 65% of the total market volume compared with 50% in 2005. Electrolux strategy is to capitalize on this increased demand in growth markets. Read more about the Electrolux strategy.

Source: Electrolux estimates.