Brazil represents about 50% of the total Latin American market for appliances. Other major markets include Mexico and Argentina. Latin America is a highly urbanized region for being a growth market. Growth is driven by rising purchasing power of households, which primarily demand more basic cookers, refrigerators and washing machines. Demand for products in the upper-price segments is also increasing among the rapidly emerging middle class in, for example, Brazil and Argentina. Despite the continued decline in the Brazilian economy in 2012, the sale of appliances rose sharply, mainly as a result of the government’s extended tax-reduction program for the purchase of domestically manufactured appliances.

Consolidated market

The Latin American market is relatively consolidated. In Brazil, the three largest manufacturers, Electrolux, Whirlpool and Mabe, account for more than 70% of sales of appliances. As a result of high import duties and logistical costs, the bulk of products sold in Latin America is produced domestically. The trend of consolidation is also strong among retailers in the region. Sales of household products are often conducted through campaigns and purchasing decisions are made in stores where it is important for manufacturers to have their own sales staff in place.

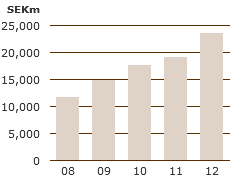

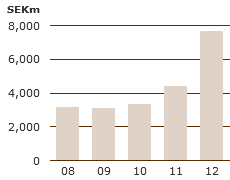

Growing shares throughout the region

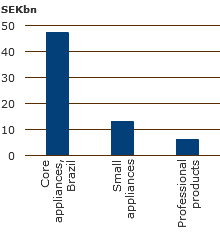

The Group’s operations in Latin America are growing rapidly and Electrolux is capturing market shares throughout the region. Brazil is the Group’s largest individual market with about 70% of sales. The Electrolux brand holds a strong position in all segments in the country thanks to innovative products and close cooperation with the market-leading retail chains. With the acquisition of the Chilean appliance manufacturer CTI, Electrolux has become the largest manufacturer of appliances in Chile and the largest manufacturer of refrigerators and freezers in Argentina. In the vacuum-cleaner segment, Electrolux has long held a leading position in the region. The Group has also established a fast-expanding business in the small-appliances category. Sales of professional food-service and laundry products remain modest but are growing across the categories.

Growth opportunities

Following the acquisition of CTI, Electrolux has established strong relationships with retailers in Chile and Argentina and has extensive distribution and an effective aftermarket business. By making further investments in production capacity and distribution, Electrolux can expand into other Latin American countries. The market for washing machines is demonstrating strong growth potential as purchasing power and demands for energy and water efficiency increase in the region. The market for small domestic appliances is large and growing rapidly.

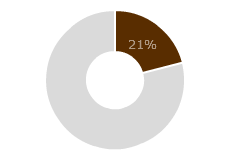

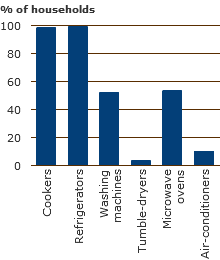

Product penetration in Brazil

Source: Electrolux estimates. |

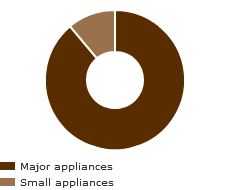

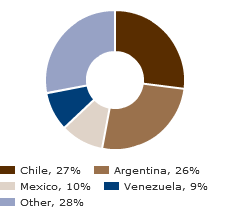

Market value

Source: Electrolux estimates. |