Africa and the Middle East comprise more than 70 countries with considerable variations in terms of wealth and degree of urbanization. The demand for appliances in Africa is growing because many people are of the age when it is time to move out and find their own homes. The degree of penetration is low in most product categories, but is displaying high growth due to the rapid rise in purchasing power of the households. In Eastern Europe, where Russia is the largest market, both average prosperity and penetration are higher. A large market for replacement products is emerging in several product categories. In Eastern Europe, Russia displayed the strongest trend in 2012.

Low degree of consolidation

With a wide geographical distribution and varying degrees of purchasing power and patterns, it is difficult for manufacturers and retailers to capture large market shares in Africa and the Middle East. Turkey has several large domestic manufacturers, such as Arcelik and Vestel, that have strong positions also in nearby regions. The markets of Eastern Europe are dominated by Western manufacturers, such as Electrolux and Bosch-Siemens, while the retailer network is domestic.

Proprietary manufacturing on location

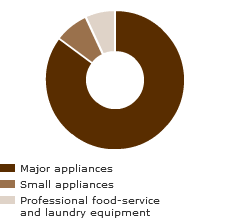

With the acquisition of the Egyptian Olympic Group, Electrolux has established a leading position in appliances in North Africa and the Middle East. Through Olympic Group, Electrolux has proprietary manufacturing in the region for such items as refrigerators, cookers, water heaters and washing machines. The Group manufactures appliances in Ukraine, Rumania, Hungary and Poland and vacuum cleaners in Hungary. About 14% of the Group’s total sales of professional food-service and laundry products are in the region and is growing significantly. Sales to commercial laundries are rising in Eastern Europe and, in the Middle East, Electrolux has started delivering laundry equipment to facility management customers.

Growth opportunities

In Africa and the Middle East, all product categories are expanding at a high rate, primarily refrigerators, cookers, washing machines and air-conditioning equipment. The integration of Olympic Group, which is proceeding according to plan, is expanding opportunities for Electrolux to capitalize on the rapid pace of growth in the region. An example of an integration activity is the new air-conditioning products that were launched in Egypt under the Zanussi brand in 2012 and are manufactured at Olympic Group’s plant. An increasing number of Eastern European households are starting to be able to afford to replace old appliances and even invest in new, more exclusive kitchen products.

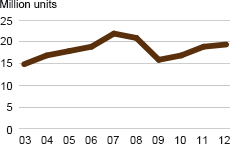

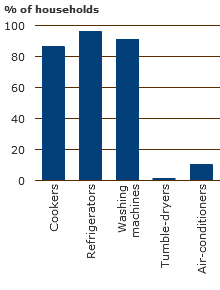

Product penetration in Eastern Europe

Source: Electrolux estimates. |

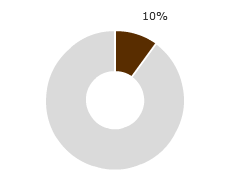

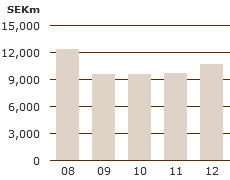

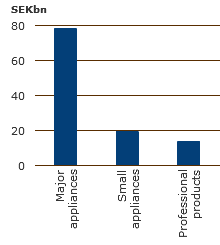

Market value

Source: Electrolux estimates. |