Political uncertainties and weak macroeconomic conditions

indirectly impact consumer sentiment and demand for appliances. This may have implications for the Group’s business and strategy in regions which carry high political and economic risks. Companies that invest in developing capabilities to move fast and be flexible and that have alternative strategies can sustain their competitive advantage despite operating in risky markets. Electrolux takes proactive steps to assess and manage risks and opportunities in its business environment.

In times of fast changes in market trends and fluctuating demand for the Group’s products, decisive actions and cost savings initiatives throughout the Group have proven that Electrolux can make timely adjustments in its production and to its cost structure. When there is strong market demand, it is essential that Electrolux can benefit from its global scale by delivering new innovative products and solutions with a high speed to market.

A number of Electrolux markets are experiencing price competition. This is particularly evident in the low-cost segments and in product categories with significant overcapacity. Electrolux has historically aimed to maintain a disciplined approach in its pricing strategy. In markets with high inflation combined with currency rate fluctuations, Electrolux has the possibility to carry out price increases to offset potential negative effects.

Regulatory changes (industry, environmental, social, labour and human rights) can impact reputation and the Group’s ability to successfully conduct business. There are a number of processes in place to control these risks such as internal and supplier auditing, environmental management and certification, the Ethics program and the safety management system. The regulatory environment is monitored in order to be prepared for changes that impact the business.

The increasing pace of change in global markets along with the digital transformation is leading to new trends that influence the appliance industry. Increased consumer power, digitalization, consolidation and sustainable development are placing increasing demand on investments and the ability to adapt, but also open up major opportunities. Electrolux is focusing investments on innovation and areas such as digitalization and connectivity and has transformed its product offering with the ambition to shape living for the better by reinventing taste, care and wellbeing experiences. The Group has also communicated ambitious targets to strengthen its sustainability footprint.

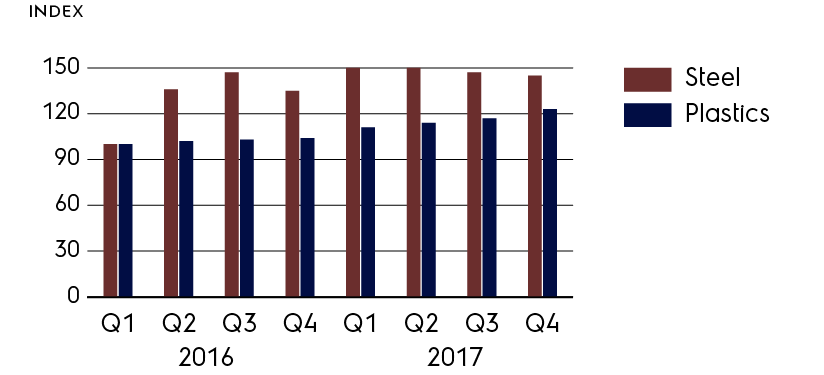

Materials account for a large share of the Group’s costs. Electrolux purchases raw materials and components for approximately SEK 47 bn, of which approximately SEK 18 bn referred to the former. Fluctuations in commodity prices impact the Group’s input costs and therefore its profitability. In order to mitigate increased input costs related to higher raw material prices, Electrolux has to take action to increase cost efficiency, negotiate purchasing contracts for commodities such as steel and chemicals or increase the prices of its products. For a sensitivity analysis on the impact of raw materials, see table below.

| Carbon steel, 38% | 38 |

| Plastics, 35% | 35 |

| Copper and aluminum, 7% | 7 |

| Stainless steel, 10% | 10 |

| Other, 10% | 10 |

| Raw materials1) | Change +/- | Pre-tax earnings impact, SEKm |

|---|---|---|

| Carbon steel | 10% | 700 |

| Stainless steel | 10% | 200 |

| Plastics | 10% | 600 |

1) Changes in raw materials refer to Electrolux prices and contracts, which may differ from market prices. The figures in the sensitivity table are rounded and as of year-end 2017.