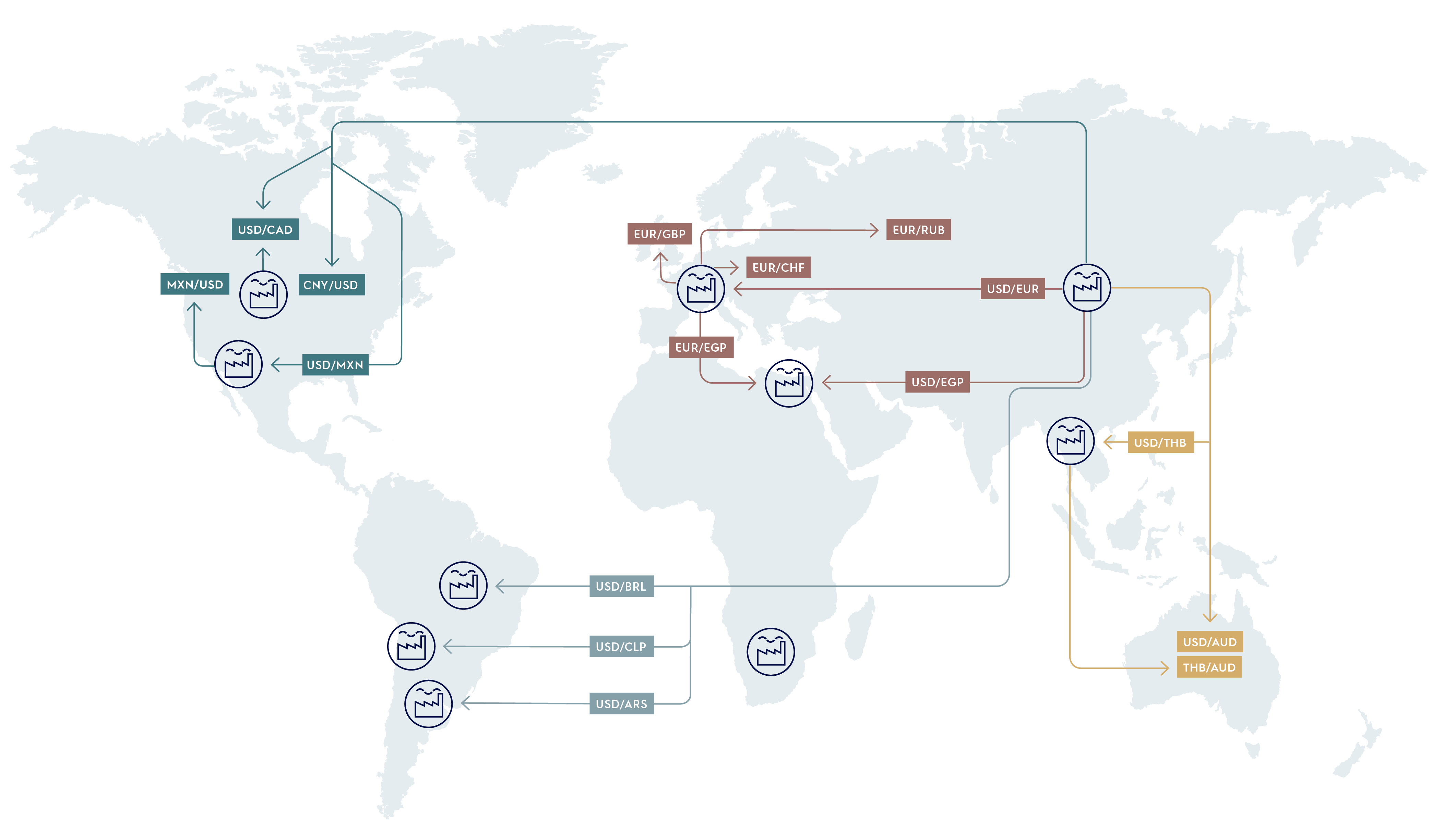

The global presence of Electrolux, with manufacturing and sales in a number of countries, offsets exchange rate effects to a certain degree. The principal exchange rate effect arises from transaction flows; when purchasing and/or production is/are carried out in one currency and sales occur in another currency.

Every month Group Treasury collects forecasts of the transaction flows for the coming 12 months from the operating units and hedges the invoiced flows.

To some extent, the Group also utilizes currency derivatives to hedge forecasted flows with both committed price and volumes. The results from the currency hedges are transferred to the operating units. It is the business areas’ responsibility to manage the FX risk of the forecasted flows through immediate price adjustment and cost reductions.

Electrolux is also affected by translation effects when the Group’s sales and costs are translated into SEK. The translation exposure is primarily related to currencies in those regions where the Group’s most substantial operations exist.

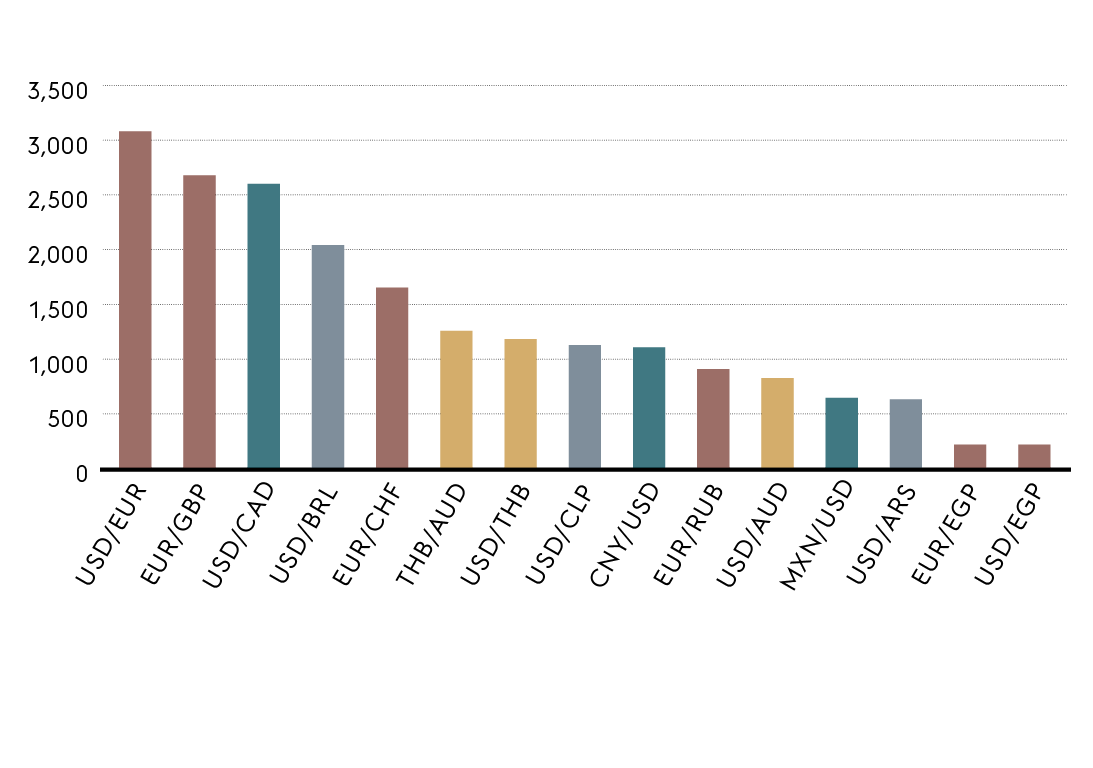

The major currencies for the Electrolux Group are the USD, EUR, BRL, CNY, GBP, CHF and CAD. The key currency pairs and flows are presented in the map together with an explanation of how they impact the Group. In general, income for Electrolux benefits from a weak USD and EUR and from a strong BRL, GBP, CAD and CHF.

In countries with large manufacturing and logistics centers, effects over time will to a large extent balance out due to natural hedging.

Compared with the previous year, changes in exchange rates for the full-year 2017 had a slightly negative impact on operating income. The total currency effect (translation effects and transaction effects) amounted to SEK -76m. The net transaction effect was SEK -119m and translation effects SEK 43m.

The largest negative impacts came from more expensive import to UK and Egypt due to the depreciation of their currencies. The negative effect was partly offset by cheaper imports to EMEA, Latin America, APAC and Canada thanks to the weaker USD, even if it also resulted in costlier imports to the U.S. from China and Mexico.

The negative net impact of currencies on operating income was mitigated by price increases and mix improvements.

A major part of the currency flows in Europe is denominated in EUR, with external imports primarily in USD. Electrolux faces some currency exposure in Eastern Europe when the cost base in the factories differs from the domestic sales.

Electrolux is a net importer into the market with flows mainly from China and production conducted in Mexico. In addition to this, the operations in Canada has an exposure to USD as Electrolux imports products into that market.

Most of the finished products originate from own factories in the region, while imported input goods such as raw materials and components are to a large extent denominated in USD.

Majority comprises local

production.

The Group is sourcing a large volume of input goods and finished goods from China to Electrolux global factories. A major part of these are invoiced in USD, but also in CNY.

The main import flows are based in THB from Electrolux factory in Thailand, but the import in USD is also significant.

|

Currency1) and interest rates |

Change +/- |

Pre-tax earnings impact, SEKM |

|---|---|---|

|

USD to EUR |

10% |

300 |

|

EUR to GBP |

10% |

260 |

|

USD to CAD |

10% |

260 |

|

USD to BRL |

10% |

200 |

|

EUR to CHF |

10% |

160 |

|

THB to AUD |

10% |

120 |

|

USD to THB |

10% |

110 |

|

USD to CLP |

10% |

110 |

|

EUR to RUB |

10% |

90 |

|

USD to AUD |

10% |

80 |

|

Translation exposure to SEK2) |

10% |

690 |

|

Interest rate |

1 percentage point |

60 |

1) Including transaction effects but not translation effects.

2) Assuming the Swedish krona appreciates/depreciates against all other currencies.