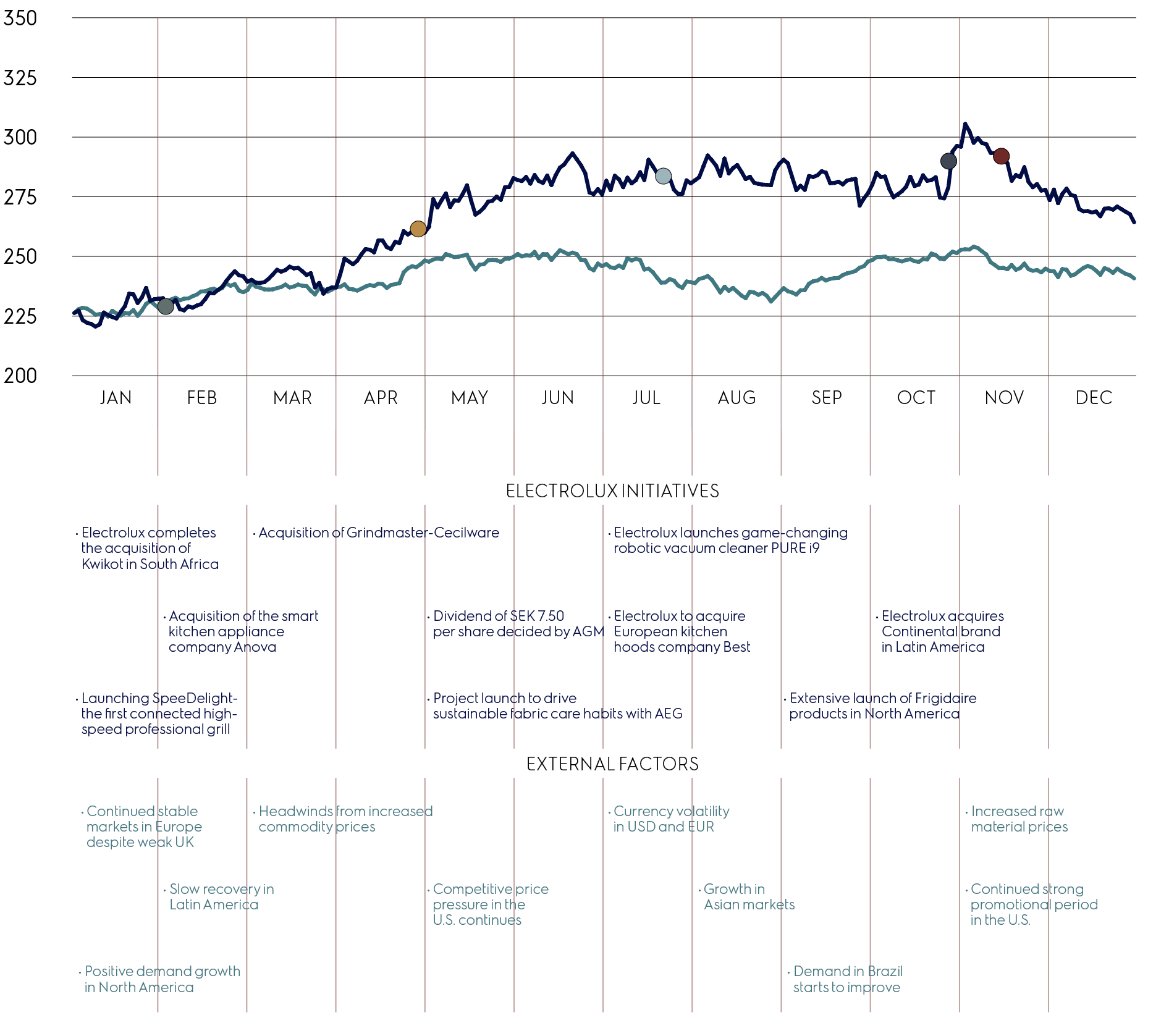

Q4

Weak organic sales growth offset by focus on product portfolio management. Stable earnings despite currency headwinds.

Q1

Solid Q1 as a result of favorable mix and improved earnings and margins supported by strong cost efficiency.

Q2

Good mix contribution from most business areas and continued strong earnings improvement driven by cost efficiencies.

Q3

Strong quarter driven by earnings improvement and increased profitability in most business areas. Focus on product portfolio management and cost efficiency continued.

CMD

Electrolux holds its CMD in Stockholm and focus key messages on the strategy, consumer excellence and operational development.

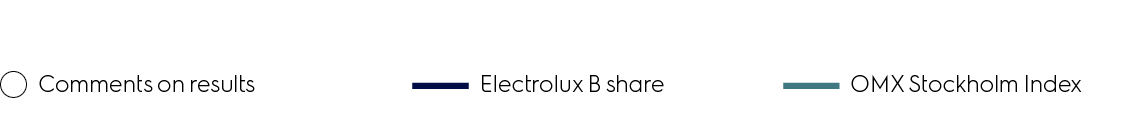

| After Q4 2016 |

After Q1 2017 |

After Q2 2017 |

After Q3 2017 |

After Q4 2017 |

|

|---|---|---|---|---|---|

| Buy | 64% | 45% | 29% | 21% | 20% |

| Hold | 18% | 33% | 42% | 43% | 60% |

| Sell | 18% | 22% | 29% | 36% | 20% |