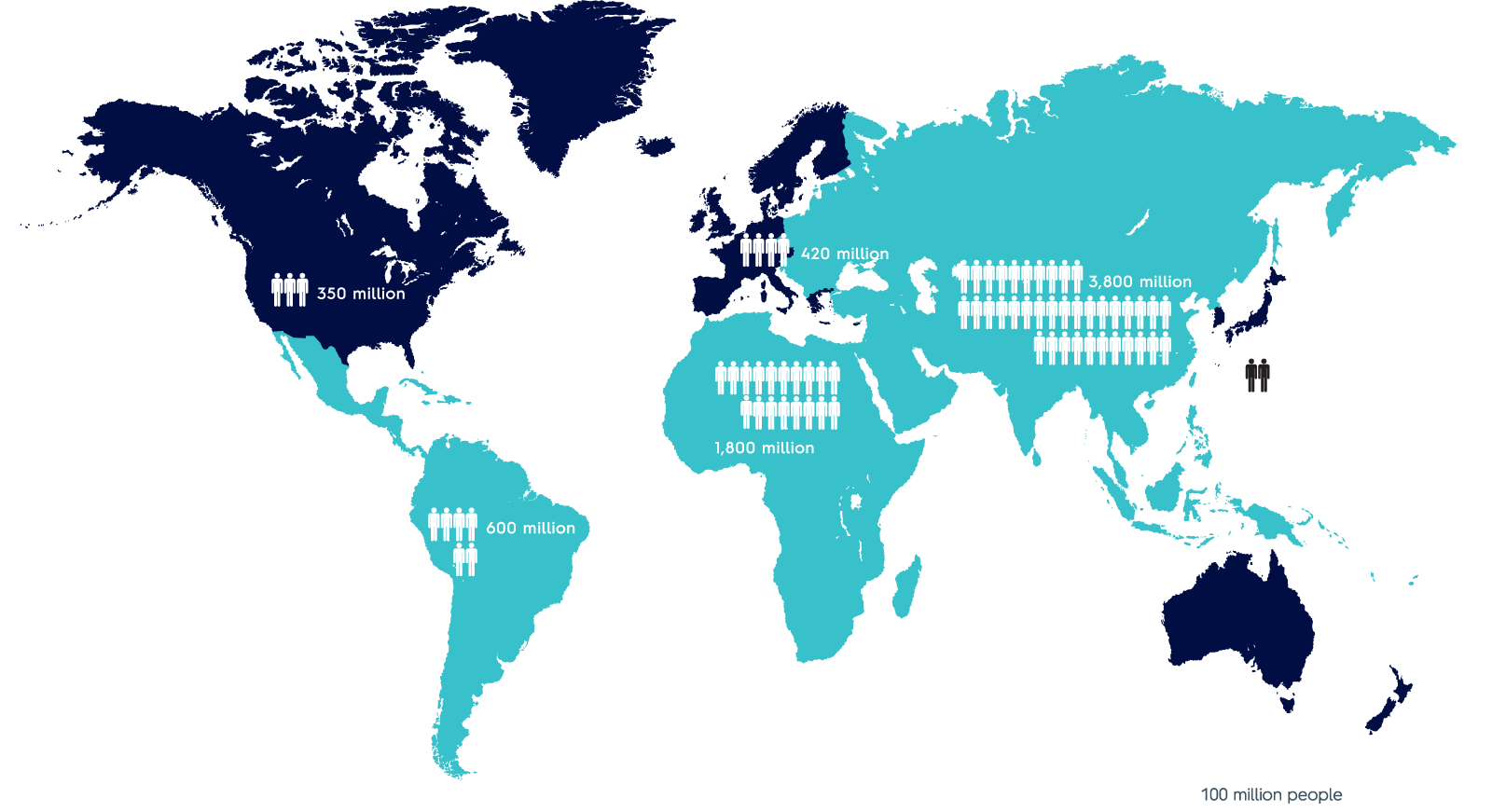

The global market for household appliances is changing, including the rapid emergence of an affluent middle class in densely populated growth markets. Electrolux aims at increasing the growth markets’ share of sales, while continuing to strengthen its position in core markets.

For simplification purposes, the global market for household appliances can be split into two parts. In the mature markets (Western Europe, North America, Japan and Australia/New Zealand), population growth is low and sales are dominated by replacement products. However, the growth markets (Africa, the Middle East, Eastern Europe, Latin America, Southeast Asia and China) are characterized by rapidly rising standards of living and a large number of new households being able to invest in appliances and other household products.

In addition to the growing middle class and the underlying economic growth, the market is driven by a number of macroeconomic factors that influence volumes and the types of products that are in demand. Factors such as increased competition for natural resources and awareness of climate changes mean that a growing number of consumers are demanding energy and resource-efficient products. Households also tend to be smaller, in terms of both living space and the number of individuals, and many consumers have decreasing time for household chores while access to information about products and services is increasing, not least over the Internet.

Manufacturers and retailers of household appliances are becoming fewer, larger and more international. The five largest manufacturers of appliances in the world – Whirlpool, Electrolux, Haier, Bosch-Siemens and LG Electronics – accounted for almost half of global sales in 2014. In recent years, manufacturers from Asia have increased their market shares. To maintain competitiveness, Electrolux will continue to leverage the global economies of scale. Focus is being directed to developing innovative products marketed under strong brands. Despite increasingly intense competition, Electrolux strengthened its positions in several key product segments in 2014.

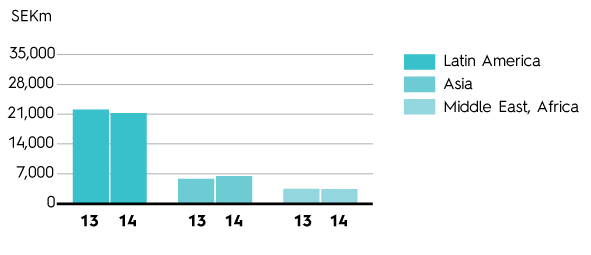

Between 2009 and 2014, global demand for appliances increased significantly, particularly due to strong growth in Asia. In parallel, demand in the Group’s mature core markets declined. In 2014, the demand in growth markets represented about 70% of the total market volume for appliances compared with 65% in 2009. Demand in growth markets declined during the year, after many years of vigorous growth, primarily due to weaker markets in Latin America and China.

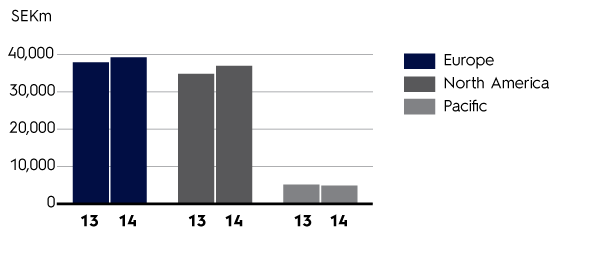

Market demand for appliances in North America continued to show healthy growth and demand in the European markets stabilized somewhat after several years of weak markets.

In 2014, growth markets accounted for about 35% of Electrolux sales and the objective is to increase this share significantly moving forward.

During the year, Electrolux signed an agreement to acquire GE Appliances, one of the leading manufacturers of kitchen and laundry equipment in the US. The acquisition is expected to be completed in 2015. More than 90% of GE Appliances’ sales is in North America and the coordination of the Electrolux Group’s and GE Appliances’ operations is expected to create a stable growth platform for the North American market. The acquisition is expected to provide Electrolux with the size and strength needed to increase the rate of investment in product development and global growth. Completion of the transaction is mainly subject to regulatory approvals. The acquisition is expected to close during 2015.

13%

Western Europe, North America, Australia, New Zealand, Japan

87%

Africa, Middle East, Eastern Europe, Latin America, Southeast Asia, China

Between 2009 and 2014, the global market demand for core appliances increased significantly, mainly due to strong growth in emerging markets particularly in Asia. Electrolux strategy is to capitalize on this increased demand in growth markets.

Source: Electrolux estimates.

| 11 | 12 | 13 | 14 | |||||||||||||

| Organic growth per quarter % | 0.8 | -1.8 | 1.4 | -0.1 | 3.3 | 5.4 | 4.2 | 7.3 | 3.7 | 5.8 | 4.9 | 3.6 | 4.5 | -3.8 | 1.6 | 2.2 |

| Sales in local currencies, SEKm | 94934 | 94503 | 94995 | 96289 | 98234 | 100738 | 102896 | 104832 | 105742 | 107255 | 108557 | 109151 | 110098 | 108808 | 108824 | 109849 |

Bosch-Siemens

Haier

LG Electronics

Whirlpool

Midea

Samsung