Core markets

Western Europe

Widely varying consumer patterns between the various countries have resulted in a low degree of consolidation with a large number of manufacturers, brands and retailers. Accordingly, the market is characterized by overcapacity and price pressure. The weak macroeconomic situation is limiting growth, but opportunities for healthy expansion exist in certain segments. There is increased demand for compact, energy-efficient and user-friendly products with good design.

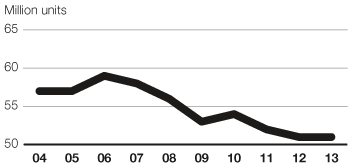

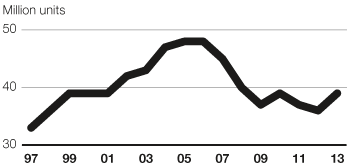

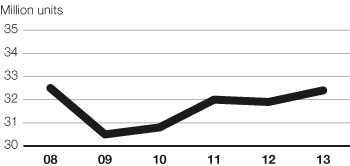

Market demand for core appliances

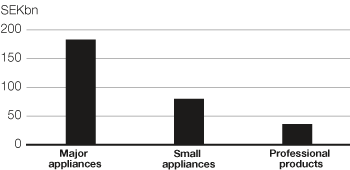

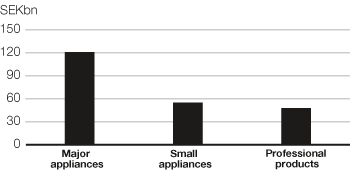

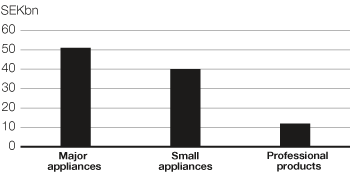

Market value

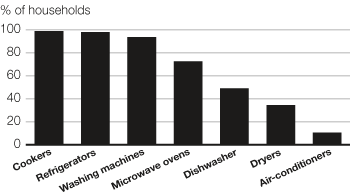

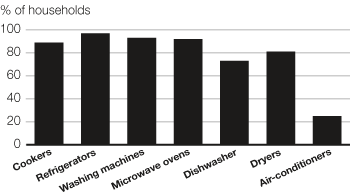

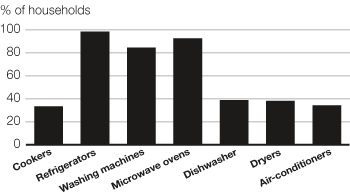

Product penetration

Electrolux competitors

Bosch-Siemens • Indesit • Whirlpool • Samsung • LG Electronics • Dyson • Miele • Ali Group • Rational • Primus

| Western Europe |

|

|---|---|

| Population: | 417 million |

| Average number of persons per household: | 2.3 |

| Urban population: | 77% |

| GDP per capita 2012: | USD 39,600 |

| Estimated real GDP growth 2012: | –0.4% |

North America

A mature, homogenous market with high penetration that is dominated by replacement products. Large homes allow space for many household appliances, including large appliances. The market is dominated by three manufacturers: Electrolux, Whirlpool and General Electric. Four major retailers sell 70% of appliances. The recovery in the housing sector generates opportunities for healthy growth for the next few years.

Market demand for core appliances

Market value

Product penetration

Electrolux competitors

Whirlpool • General Electric • LG Electronics • Samsung • Dyson • TTI Group (Dirt Devil, Vax and Hoover) • Bissel • ITW

| North America |

|

|---|---|

| Population: | 348 million |

| Average number of persons per household: | 2.6 |

| Urban population: | 82% |

| GDP per capita 2012: | USD 51,800 |

| Estimated real GDP growth 2012: | 1.8% |

Australia, New Zealand and Japan

Japan is the world’s third-largest single market and is dominated by major domestic manufacturers and retailers. Small living spaces have led to consumers demanding compact products, such as handheld vacuum cleaners. Penetration is high in Australia and New Zealand and demand is primarily driven by design and innovations as well as water and energy efficiency. Competition between manufacturers from Asia and Europe is intense.

Market demand for core appliances

Market value

Product penetration

Electrolux competitors

Fischer & Paykel • Samsung • LG Electronics • Panasonic • Dyson • ITW • Hoshizaki • Alliance

| Australia, New Zealand and Japan |

|

|---|---|

| Population: | 154 million |

| Average number of persons per household: | 2.5 |

| Urban population: | 91% |

| GDP per capita 2012: | USD 49,500 |

| Estimated real GDP growth 2012: | 2.6% |

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.