Innovation

Electrolux is the only appliance manufacturer in the world to offer complete solutions for both consumers and professional users. The Electrolux process for consumer-driven product development enables the development of products that will be preferred by more consumers. The collaboration between marketing, R&D and design is a key factor, as is the transfer of know-how from the Group’s professional business to consumer products.

Design awards In 2013, Electrolux received several prestigious design awards, such as red dot design, iF design, Design index and Australian International Design.

Kitchen

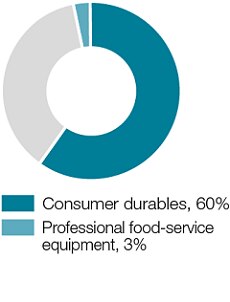

Share of Group sales 2013

|

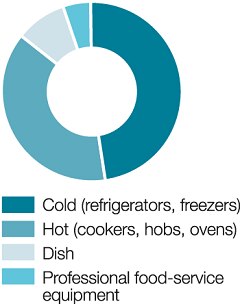

Kitchen product categories

|

|---|

Electrolux kitchen products account for almost two-thirds of the Group’s sales and the company holds strong positions in all major categories of kitchen appliances and commands significant global market shares. The most rapid increase in sales is occurring in growth regions such as Latin America and Southeast Asia, where the Electrolux offering is primarily targeted to the fast-growing urbanized middle class. For many years, Electrolux has been a recognized leader in cookers, hobs and ovens and has developed numerous new functions that simplify cooking for both households and professionals. In 2013, a large number of new innovative products were launched, such as the CombiSteam SousVide oven and vacuum sealer in Europe and the Frigidaire 50/50 Symmetry Double Oven in North America. The biggest launch was made in China, with more than 60 new products for kitchen and laundry. The Group has strengthened its leading position in built-in appliances in recent years through extensive product launches and partnerships with kitchen manufacturers.

Electrolux provides restaurants and industrial kitchens with complete solutions for cookers, ovens, refrigerators, freezers and dishwashers. Products are largely sold as modules, allowing buyers to choose suitable functions to meet their needs. Electrolux conducts operations worldwide and has a global service network. The strongest position is held in Europe, where half of all Michelin-starred restaurants use kitchen appliances from Electrolux.

Trends

The rapid changes in lifestyle in many countries have led to demand for products that make life easier and that make cooking healthier and food storage safer. Interest in more advanced cooking is rising mainly in mature economies. More and more people want to emulate professionals and are looking for products and functions used by the very best chefs. Buyers of professional food-service equipment have widely differing yet strict requirements, for example, regarding performance and technology, implying that manufacturers must be able to deliver flexible solutions. Both consumers and professionals want products with low water and energy consumption that are manufactured from sustainable materials and can be easily recycled.

Growth opportunities

Alongside the expansion generated by the greater purchasing power of households in growth markets, innovations are driving substantial growth in certain segments of the kitchen appliances market, such as combination steam ovens, induction hobs with preset cooking zones and refrigerators with advanced refrigeration technology. In some regions, most households still have no dishwasher, despite the volumes of water that can be saved by having a machine do the washing rather than washing dishes by hand. The development of new, water and energy-efficient dishwashers for both households and professional users is progressing rapidly at Electrolux.

Laundry

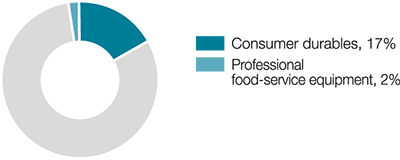

Share of Group sales 2013

Washing machines and tumble-dryers represent a product category with major growth potential, particularly as a result of increased water shortages around the world. Electrolux has a strong position in most regions and is producing high-performance solutions in terms of water and energy efficiency for both households and professional users. The largest global market share is in front-load washing machines, where the Group is a leading producer. For professional users, Electrolux sells advanced laundry solutions for different segments such as laundry rooms in apartment buildings, hotels and hospitals as well as commercial laundries. The majority of sales in the professional market is generated in Europe, although the most rapid increase in sales is taking place in the US, Southeast Asia and Japan.

Electrolux develops innovative solutions for washing machines and tumble-dryers for households based on its expertise in professional laundry products. Two new industry-leading products launched in 2013 were AEG ÖkoKombi, the world’s first washer-dryer with heat pump technology, and the AEG ÖkoMix washing machine with A+++–50% energy rating.

Electrolux professional washing machines and tumble-dryers are among the most energy and water-efficient in the market.

Growth opportunities

A fast-growing segment for Electrolux is professional laundry solutions for quickly washing housekeeping materials and towels, for example, for hotels, care institutions and facility management. Energy-efficient and gentle tumble-dryers are another growth area. Electrolux is a leader within this area and is continuously launching new, innovative and energy-efficient tumble- dryers for consumers and professional users.

Small appliances

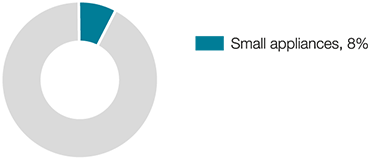

Share of Group sales 2013

As one of the few global manufacturers of vacuum cleaners, Electrolux can focus on global product development. A special focus lies on innovative and energy-efficient vacuum cleaners in the upper-price segments. Electrolux is also market-leading in the central vacuum-cleaner segment and holds a substantial market share in vacuum-cleaner accessories. The majority of sales is generated in Europe and North America, while Asia and Latin America account for the fastest growth.

Trends in floor-care products

Consumers want vacuum cleaners that have high suction power and are ergonomic, quiet and user-friendly. The growing number of small households across the world results in increasing demand for small, compact and efficient vacuum cleaners. They should also have an appealing design that means that they do not need to be hidden away. Increasing environmental awareness is driving demand for vacuum cleaners that use less energy and that are sustainably manufactured.

Electrolux continuously develops innovations and models with attractive designs that can be customized to a variety of segments and regional requirements. Electrolux holds a leading position in rechargeable, handheld vacuum cleaners in Europe and also has a strong position in other parts of the world where compact vacuum cleaners are in demand, such as Japan and South Korea.

Small domestic appliances

The global market for small domestic appliances is significantly larger than the vacuum-cleaner market and shows significantly faster growth. The Group’s offering in this product category has increased substantially in recent years, primarily through products in the upper-price segments with distinctive design, sales are conducted across the globe with the largest share in Europe, closely followed by Latin America. The offering varies according to market but the primary focus is on five product groups – coffee-makers, kettles, mixers, food-processors and irons.

In Europe, sales of coffee-makers is the fastest-growing subcategory within small domestic appliances, which in turn is growing faster than the total market for household appliances. Latin America accounts for the largest share of small domestic appliances of all regions and is growing rapidly as the purchasing power of households increases. Electrolux has strong positions in the irons, coffee-makers and mixers categories.

Asia is both the largest and fastest growing market in the world for small domestic appliances. Electrolux focuses on launching strong offerings in four categories - rice cookers, mixers, compact ovens and irons – all of which hold potential for rapid growth in the region.

Adjacent product categories

Share of Group sales 2013

Adjacent product categories encompass several areas for which Electrolux has identified opportunities for profitable growth. Electrolux can take advantage of existing strong product ranges and develop the market’s best service and strengthen its offering of spare parts and accessories. In parallel, there are adjacent product categories in which Electrolux sees growth opportunities. Air-conditioning equipment and water heaters are two such product categories.

Considerable potential for accessories

In certain industries, sales of accessories account for up to 30% of the sales value of the underlying product. For appliances, the corresponding figure is just a few percentage points. In 2013, a new product range was launched in Europe that included items such as baking trays, cleaning fluids for hobs and digital thermometers.

Air-conditioning equipment and water heaters

Although the global market for air-conditioners and water heaters is of the same size as the market for refrigerators and freezers, it will probably expand at a faster rate moving forward. Electrolux adapts its offering on the basis of different regional and local needs and has identified growth opportunities in all regions of the world.

For air-conditioners, the Group already holds a strong position in Brazil, the US and Australia. Electrolux is well advanced in terms of low noise levels and has a strong offering in the areas of service and installation. In hotter parts of the world, air-conditioners are usually one of the first household appliances in demand by households when their purchasing power increases.

StopSearchHereCEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.