- Weak market conditions in core markets in Europe adversely impacted earnings for appliances, professional products and small appliances.

- Measures to improve manufacturing footprint were initiated, and SEK 1,032m was charged to operating income.

- Operating income for appliances in North America improved significantly and the Group gained market share.

- Strong volume growth and improved results for the operations in Latin America.

- Continued good sales growth and earnings trend in Asia.

- Average number of employees increased to 59,478 (52,916), due to the acquired companies Olympic Group and CTI.

The Group’s operations include products for consumers as well as professional users. Products for consumers comprise major appliances, i.e., refrigerators, freezers, cookers, dryers, washing machines, dishwashers, room air-conditioners and microwave ovens, floor-care products and small domestic appliances. Professional products comprise food-service equipment for hotels, restaurants and institutions, as well as laundry equipment for apartment-house laundry rooms, launderettes, hotels and other professional users.

In 2012, appliances accounted for 87% (86) of net sales, professional products for 5% (6) and small appliances for 8% (8).

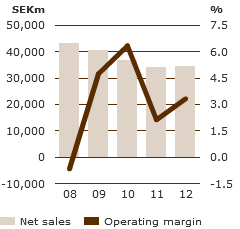

Major Appliances Europe, Middle East and Africa

Market demand for appliances in Europe declined by 1% year-over-year in 2012. Western Europe declined by 2% as a result of weak demand in Southern Europe and the Benelux countries. Demand in Eastern Europe rose by 3%, driven mainly by growth in Russia, while demand declined in the rest of Eastern Europe.

Group sales increased year-over-year, in comparable currencies, as a result of the acquired company Olympic Group, but also as a result of higher sales volumes. Market shares increased somewhat. The launch of the next generation of high-end appliances under the Electrolux brand and the launch of Zanussi products in the mass-market segment, together with the previous launch of AEG products, have all contributed to the development.

Operating income declined compared to 2011, excluding non-recurring costs, as a result of lower sales prices, a deterioration in country mix and negative results in Egypt. The country mix deteriorated as a result of higher sales in Eastern Europe and lower sales in Southern Europe and the Nordic countries.

However, increased manufacturing efficiency and cost savings contributed to the operating income.

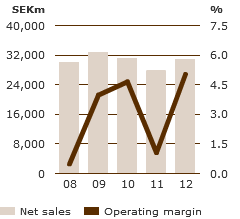

Major Appliances North America

Market demand in North America for core appliances declined by 2% in 2012 compared with the year-earlier period. Market demand for microwave ovens and home-comfort products, such as room air-conditioners increased by 1%. In total, major appliances was unchanged in 2012 year-over year.

Group sales in North America increased in 2012 year-over-year due to higher volumes of core appliances and improvements in price and mix. Sales volumes rose in several of the product categories in core appliances and the Group captured market share.

Operating income improved substantially, mainly as a result of higher sales prices but also due to higher volumes of core appliances.

During the fourth quarter of 2012, operations in North America were impacted by extra costs totaling approximately SEK 100m. Costs for warehousing and transportation were temporarily higher as a result of entering new distribution channels. In addition, production costs increased due to the consolidation of cooker production, with manufacturing being relocated from L’Assomption in Quebec, Canada, to Memphis in Tennessee, USA.

These activities will continue to impact operating income in 2013, although to a lesser degree.

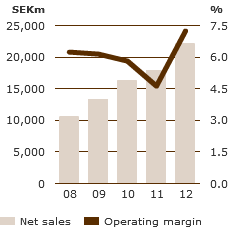

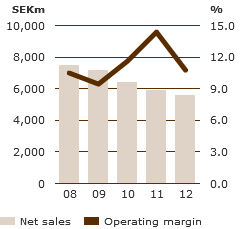

Major Appliances Latin America

Market demand for core appliances in Latin America is estimated to have continued to increase in 2012 year-over-year. Demand for core appliances in Brazil continued to grow mainly as a result of tax incentives for appliances, a program that has been partially extended to June 2013.

Sales for the Latin American operations in 2012 rose year-over-year as a result of continued volume growth and an improved mix. Sales in other Latin American markets outside Brazil increased to about 32% (25) of total sales in 2012, primarily as a result of the acquisition of CTI in Chile.

Operating income improved significantly and was the highest ever recorded. Strong volume growth, higher prices and an improved product and customer mix contributed to the strong results. The strengthening of the US dollar against the Brazilian real had a negative impact on operating income.

The successful integration of the acquired company CTI in Chile also contributed to the strong results in 2012.

Major Appliances Asia/Pacific

Australia and New Zealand

Market demand for major appliances in Australia is estimated to have declined in 2012 year-over-year. Group sales decreased during the year, primarily as a result of lower sales volumes and prices and a negative customer mix.

Operating income declined for the full-year 2012, mainly due to declining volumes as a result of a weak market. Lower sales prices also had a negative impact on operating income. Cost savings and favorable currency movements contributed positively to operating income.

Southeast Asia and China

Market demand in Southeast Asia is estimated to have continued showing growth in 2012 year-over-year. Demand in China declined, while Electrolux sales in Southeast Asia and China displayed strong growth and the Group’s market shares are estimated to have grown.

Operations in Southeast Asia demonstrate favorable profitability and the Group’s operation in China made a positive contribution to the income trend.

Small Appliances

Market demand for vacuum cleaners in Europe and North America declined in 2012 compared with the previous year.

Group sales increased year-over-year, mainly as a result of strong sales growth for small domestic appliances, particularly in Asia/Pacific. Higher sales of vacuum cleaners, mainly driven by promotion activities in North America around Black Friday, also contributed to the rise in sales and the Group captured market shares.

Operating income for the full year 2012 declined year-over-year. The weak markets in Europe and North America had a negative impact on prices and product mix and operating income declined. In addition, increased costs for sourced products adversely impacted income in 2012. The acquired company Somela (CTI) in Chile had a positive impact on results.

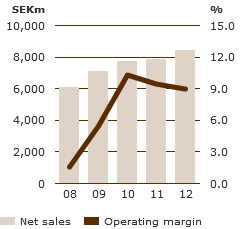

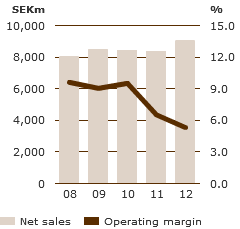

Professional Products

Weak market demand in Europe for both professional food-service equipment and laundry equipment had a negative impact on the Group's sales volumes in 2012.

Sales of food-service equipment declined year-over-year due to lower volumes. Operating income declined as a result of lower sales volumes and a negative mix. However, price increases and productivity improvements partly offset the decline in operating income.

Continued investments related to the launch of the new ultra-luxury product range Electrolux Grand Cuisine negatively impacted operating income for 2012.

Sales of professional laundry equipment declined as a result of lower volumes and operating income declined. Price increases and a positive development of the product mix contributed to operating income.

Operating margin for Professional Products remained stable.