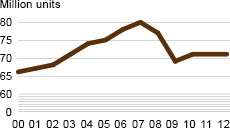

A total of approximately 71 million core appliances were sold in Europe in 2012, which is about 11% lower than the record year of 2007.

- Strong sales growth in growth markets and in North America.

- Operating income improved substantially for appliances in North America and Latin America.

- Volume growth and price increases contributed to the favorable trend in operating income.

- Weak market conditions in Europe adversely impacted results for appliances, professional products and small domestic appliances.

Market overview

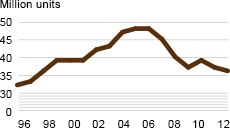

Market demand for appliances in Electrolux core markets continued to decline in 2012 year-over-year, while demand in growth markets continued to grow.

Market demand for core appliances in Western Europe and North America declined by 2%. Market demand in Australia is estimated to have declined.

Market demand in Eastern Europe increased by 3% and demand in Latin America and Southeast Asia continued to show growth. Market demand for core appliances in Europe in 2013 is expected to decline, while demand in North America is expected to increase.

Net sales and operating income

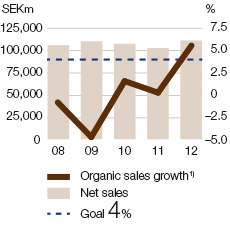

Net sales for the Electrolux Group in 2012 improved by 9.4% in comparable currencies. Sales growth referred mainly to growth markets and were particularly strong in Latin America. All business areas except for Professional Products showed sales growth.

The negative trend in market conditions in the core markets in Europe has adversely impacted results for the Group’s operations in the region. However, volume growth, price increases and extensive product launches, particularly in Latin America and North America, contributed to the improvement in operating income for 2012.

Costs savings and the ongoing global initiatives to reduce complexity and improve competitiveness within manufacturing also contributed to the favorable income trend.

Financial goals over a business cycle

The financial goals set by Electrolux aim to strengthen the Group’s leading, global position in the industry and assist in generating a healthy total yield for Electrolux shareholders.

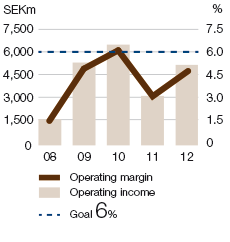

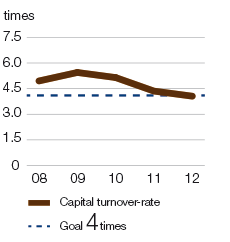

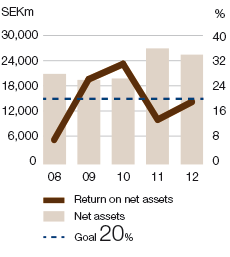

The organic sales growth in 2012 of 5.5% far exceeded the goal of 4%. Total sales increased by 9.4%, in comparable currencies, of which 5.5% was organic growth and 3.9% acquisitions. Operating margin showed a positive trend and amounted to 4.7%. The capital turnover-rate declined to 4.0, while return on net assets increased to 18.8%. The acquired companies Olympic Group and CTI have impacted these key ratios negatively, while the Group's ongoing structural efforts to reduce tied-up capital has contributed positively.

Sales growth 1) In comparable currencies. |

Operating margin Key ratios are excluding items affecting comparability. |

Capital turnover-rate |

Return on net assets Key ratios are excluding items affecting comparability. |

Structural changes in 2012

In 2012, Electrolux continued the work to increase production competitiveness by optimizing its industrial production system, as communicated at the Capital Markets Day in November 2011.

Several activities have been initiated within the business area Major Appliances Europe, Middle East and Africa. Total costs of SEK 1,032m was charged to operating income within items affecting comparability. Read more about structural changes.

Launches of new products and new sales channels

In 2012, Electrolux launched the first and only professional cooking system for consumer homes, Electrolux Grand Cuisine, in the ultra-luxury segment. In Europe, Electrolux launched the Inspiration Range, a complete range of appliances under the Electrolux brand. The products are being launched across all core markets in Europe.

In the US, Electrolux is entering the world's largest home improvement specialty retailer, The Home Depot. Read more in Operations by business area.