– growth in share of replacement appliances

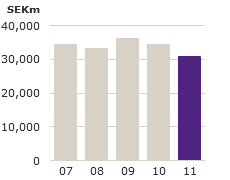

The weak economic environment, cautious consumers and low activity in the housing-construction sector resulted in continued low sales of household appliances in North America in 2011. Electrolux was able to defend its position in the region.

North America is a mature market with high penetration in most product categories. The average living space of households is above that of other regions, which means space is available for both many and large household appliances. A high degree of product penetration combined with relatively low population growth has resulted in replacement products dominating the market. Due to the turbulent economic climate, this trend has been amplified in recent years. Replacement appliances accounted for a major share of total sales in the market 2011. A total of 37 million appliances were sold in 2011, which is on a par with 1998 volumes and represents a decline of 23% compared with the peak year of 2006.

A consolidated market

The market in North America is more uniform than most markets, which has led to a relatively high level of consolidation among producers and retailers. The three largest manufacturers of appliances in the US account for a major part of the market and about 70% of appliances are sold via the four major retailers Sears, Lowe’s, Home Depot and Best Buy. The four largest manufacturers of vacuum cleaners represent over 50% of the market. Vacuum cleaners are sold mainly through supermarkets, discount stores and department stores, such as Wal-Mart, Target and Sears. The degree of consolidation is also high among manufacturers and retailers of food-service and laundry equipment.

The Group’s position

Electrolux commands a strong position in appliances and vacuum cleaners in the US and Canada. The Group’s appliances are mainly sold under the Frigidaire brand in the mass-market segment and vacuum cleaners under the Eureka brand. The extensive launch of innovative appliances under the Electrolux brand in 2008 and 2009 has yielded a strong position for the Group in the profitable premium segment, which Electrolux can leverage when demand rebounds.

The Group’s professional kitchen business is still small but growing both in traditional segments and chains. Electrolux Professional laundry equipment is sold via a distributor with a growing share of sales under the Electrolux brand beside the traditional Wascomat brand.

Fast-growing product categories

The share of discretionary sales and purchases made in connection with new housing has drastically declined in recent years as a result of heightened economic uncertainty. A possible recovery in the new-housing sector will result in a rise in demand for primarily cookers and ovens. Electrolux has a competitive offering in the segment and healthy relationships with leading retailers and kitchen manufacturers in the region. In 2011, the Group launched its first range of small appliances for US households, including coffee-makers, toaster ovens, toasters, slow cookers and irons. This product category demonstrated a high rate of growth.

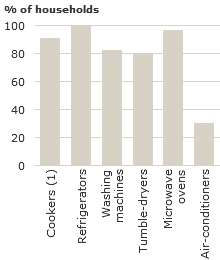

Product penetration

1) Free-standing cookers. |

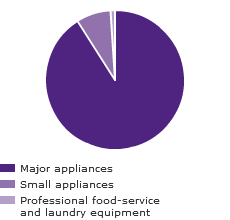

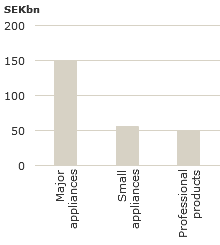

Market value

|

Source: Electrolux estimates.