– continued high growth rate

The innovative products developed by Electrolux to meet the specific needs of Southeast Asian households in terms of temperature, humidity and food culture have generated sharp growth, high profitability and increasing market shares. In China, Electrolux has made a significant transformation of the business.

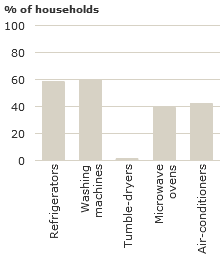

China is the world’s largest manufacturer of household appliances and also the largest market measured in terms of volume. Demand has been driven by high growth combined with rapid urbanization. This urbanization trend will continue in parallel with an eventual easing of population growth and the rise in the number of households. Penetration in various product categories is high in cities while it is lower in rural areas. Households are often small with limited space to accommodate many appliances. Small living spaces also dominate in Southeast Asia – a region undergoing rapid urbanization and population growth. There is a considerable difference in the degree of product penetration between the various countries in Southeast Asia. Many households are not equipped with a cooker, but use other alternatives to cook food, such are rice-cookers and gas burners. Similar to other growth markets, consumers prioritize refrigerators, washing machines and air-conditioning equipment as prosperity rises.

Major players in China

There is no clear market leader in Southeast Asia. Although consumers prefer European brands, market shares remain low. In China, a rapid consolidation of the number of manufacturers is currently under way, with Haier and Midea far ahead in terms of size in the country. Foreign manufacturers still only hold small market shares, although they are growing fast in the premium segment. There are no retailers with a region-wide network in Southeast Asia. However, there is a trend toward increased consolidation among retailers in various countries. In China, the market is dominated by two large domestic retailer chains – Gome and Suning – specializing in electronics.

The Group’s position

Electrolux is a reputable brand in Southeast Asia and commands a strong position in the premium segments for appliances. The Group’s market-leading position for front-load washing machines has been leveraged to expand the business to kitchen appliances.

Structural measures in China

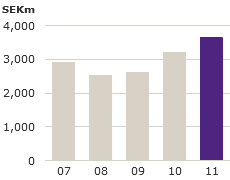

In China, Electrolux has implemented structural actions and repositioned its product offering after some difficult years since the Group entered China in the mid-1990s. Sales to retailers in rural areas have been discontinued and the current focus is on the rapidly growing middle class in major cities. Electrolux sells its products through the largest retailers. In 2011, Electrolux increased its sales in the country by approximately 30% through successful launches of new products.

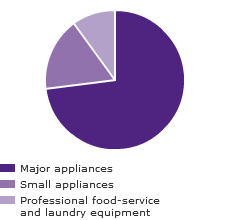

Fast-growing product categories

The exponential growth of the middle class in the region has generated heightened demand for such products as air-conditioning equipment, refrigerators and washing machines. In China, Electrolux successfully launched a new range of refrigerators. In Southeast Asia, Electrolux has launched new models for air-conditioning equipment that consume 20–30% less energy than conventional models. Built-in products for the kitchen comprise another expanding segment, driven partly by the urbanization taking place throughout the region. In Southeast Asia, the market for vacuum cleaners and small domestic appliances is also growing rapidly, albeit from relatively low levels.

Read more about Electrolux operations in Southeast Asia.

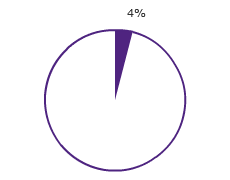

Product penetration in

|

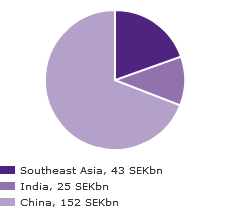

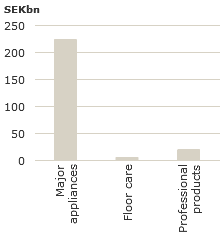

Market value – Southeast Asia and China

|

Source: Electrolux estimates.