– a fragmented market

Western Europe is the Group’s largest market for consumer durables and products for professional users. Electrolux focuses on growth through the launch of new, innovative appliances in the premium segments. Built-in appliances is a priority area.

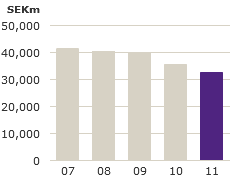

The market in Western Europe is dominated by replacement products as a result of high penetration in most product categories and low or stagnated population growth. Meanwhile, an increase in the number of households due to a rising share of older people combined with the small living spaces in most homes, has led to higher demand for compact and user-friendly products. Therefore, the market for built-in appliances is a growing segment in Europe. In 2011, deliveries of core appliances amounted to about 52 million units, down by 12% on the record year of 2006. The sharp deceleration in primarily Southern Europe had a negative impact on development. The market remained subject to price pressure and intensified competition from Asian manufacturers, among others.

A fragmented market

Europe is a complex market. Many countries and language areas have resulted in widely varying consumer patterns and the establishment of a large number of manufacturers, brands and retailers for appliances. The low degree of consolidation among manufacturers is one reason for overcapacity and price pressure in the industry. The European market features many small, local and independent retail chains that focus on electrical and electronic products as well as kitchen interiors. Kitchen specialists currently account for approximately 25% of sales of household appliances in Western Europe. The corresponding figure for Germany and Italy is approximately 40%.The market for professional kitchens is characterized by the presence of many manufacturers who often specialize in only one product category. Conversely, the market for professional laundry equipment is served by fewer players able to supply a larger product portfolio.

The Group’s position

Electrolux is the only producer in the market that can provide solutions for both consumers and professional users of kitchen appliances and laundry products. In recent years, the Group has further strengthened its position in the built-in segment for core appliances, mainly in the German market. In 2010 and 2011, the Group launched new built-in products in the premuim segment under the AEG brand. In 2012, the Group will move forward with the launch of an entirely new range of built-in products under the Electrolux brand.

For professional users, Electrolux has a strong position with independent restaurants and institutions.

Electrolux is one of the leading producers of floor-care products in the world and one of few with a global distribution network. The Electrolux brand dominates the Group’s sales in Europe, one of the Group’s largest markets.

Fast-growing product categories

The market for built-in appliances continues to show growth and interest is strong in energy- and water-efficient appliances. Dishwashers comprise a fast-growing segment in the region. Electrolux manufactures dishwashers designed and adapted for all types of kitchens and households. In 2011, the Group launched new, innovative and water-efficient dishwashers under the AEG brand. Attractively designed, rechargeable and instant vacuum cleaners displayed substantial growth. The market for bagless vacuum cleaners also grew.

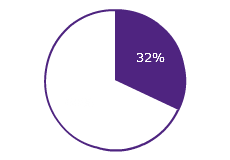

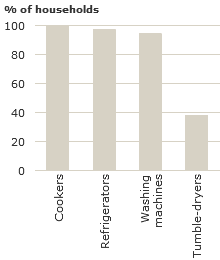

Product penetration

|

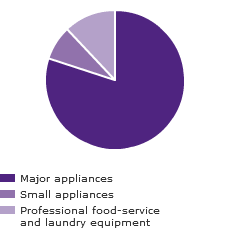

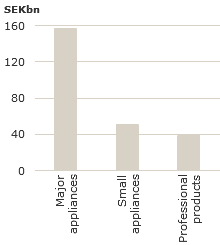

Market value

|

Source: Electrolux estimates.