Electrolux is well positioned to take the next step on the path to profitable growth, as several important prerequisites for growth are in place.

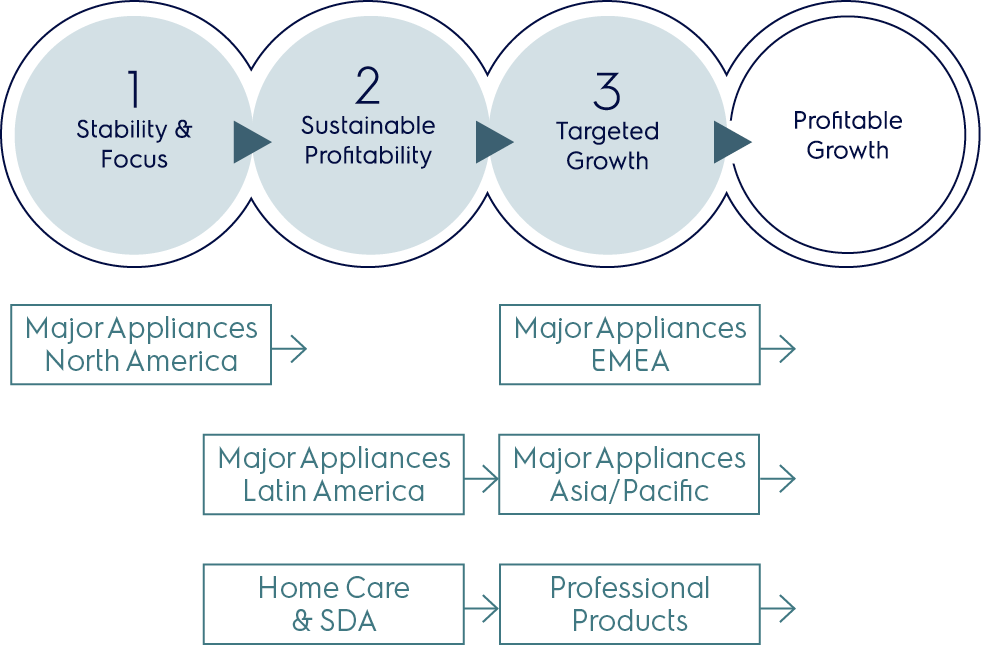

In 2017, the Group made good progress on the path to profitable growth. The aim is to continue this journey toward targeted growth,

and several important prerequisites for this are now in place.

Underlying market growth The overall positive demand trend across most markets in 2017 is expected to continue in 2018.

More business areas in targeted growth Two more business areas, Core Appliances EMEA and Core Appliances Asia Pacific, reached the targeted growth stage during the year. Professional Products has been at this stage for several years. All three remaining business areas advanced along the path.

Product portfolio management The active product portfolio management has to a large extent focused on profitable product categories with consumer relevant innovations and exiting unprofitable categories and markets. This focus is shifting toward growth and to grow profitable product categories.

Innovation bearing fruit The Group’s efforts to deliver best-in-class consumer experiences in Taste, Care and Wellbeing have created new products, with improved and simplified usage and higher quality, that are being very well received by the markets.

Competitive cost structure Electrolux has continuously through improved ways of working, a higher resource efficiency and

simplification increased cost efficiency.

Higher value-creating investments Comprehensive re-engineering programs in manufacturing have been initiated. These investments in innovations for new products and increase productivity will drive further growth.

Active M&A approach Acquisitions are an integrated part of the efforts to improve and expand the product offering for best-in-class consumer experiences. Electrolux aims to leverage the five acquisitions made in 2017 – Kwikot, Grindmaster-Cecilware, Anova, Best and the Continental Brand – to broaden and strengthen the product offering and drive growth.

Electrolux has a number of key competitive advantages on the continued journey on the path to profitable growth.

An extensive product range make Electrolux a leading manufacturer, and the only player that offers complete solutions for both consumers and professional users.

A global presence generates economies of scale and contributes to an effective cost structure. An extensive global modularization program is ongoing concerning manufacturing, improved efficiency, procurement of raw materials and components.

Strong brands, including: AEG, Electrolux, Frigidaire, Westinghouse and Zanussi. Professional expertise in cooking and laundry contributes to creating innovative solutions for consumer products.

Professional expertise in cooking and laundry contributes to creating innovative solutions for consumer products.

Strong global positions. Kitchen appliances account for almost two thirds of the Group’s sales and the company holds strong positions in all major categories of kitchen appliances and commands significant global market shares. The Group also holds strong positions for front-load washing machines and dishwashers, which are segments with low penetration in many markets. Electrolux also commands a strong global position in vacuum cleaners and are expanding its offering in Home Care with small domestic appliances, air-conditioning equipment and water heaters.

Consumer insight has for many years been the focus of all product development within the Group. By performing an extensive number of interviews and home visits as well as the Group’s usability labs, Electrolux gains knowledge of consumer behavior and needs.

The Scandinavian design heritage plays a key role in shaping the Group’s design activities and in the development of new and sustainable appliances.

A leading position in sustainability. Electrolux has a strong track record in developing and manufacturing smarter, more accessible and resource-efficient solutions that meet the increasing requirements of consumers, customers and other stakeholders in the market.

Employees and culture play a crucial role in Electrolux achieving its targets and vision. Electrolux aims to drive a culture enabling the right behaviors for a high performing and learning organization.

Taste, Care and Wellbeing are at the core of Electrolux consumer offering.

SHARE OF GROUP SALES

| Kitchen, 60% | 60 |

| Laundry, 17% | 17 |

| Small appliances, 6% | 6 |

| Home Care and Services, 11% | 11 |

| Professional kitchen, 4% | 4 |

| Professional laundry, 2% | 2 |

KITCHEN PRODUCT CATEGORIES

| Cold (refrigerators, freezers), 46% | 46 |

| Hot (cookers, hobs, ovens), 38% | 38 |

| Dish, 10% | 10 |

| Professional food-service equipment, 6% | 6 |