Net sales increased by 0.8%, organic growth was slightly down while acquisitions contributed to sales. Organic growth across most regions while active product portfolio management to exit from unprofitable product categories as well as lower volumes under private labels in North America impacted sales negatively.

Operating margin improved to 6.1%. Four of six business areas reached an operating margin above 6%. Increased efficiency and product-mix improvement contributed to the positive earnings trend.

Operating cash flow after investments amounted to SEK 6.9bn. The main contributor to this solid cash flow is the earnings development. Acquisitions of SEK 3.4bn impacted cash flow negatively.

| 13 | 14 | 15 | 16 | 17 | |

| Net sales, SEKm | 109151 | 112143 | 123511 | 121093 | 122060 |

| Operating margin, % | 1.4 | 3.2 | 2.2 | 5.2 | 6.1 |

7,407

SEKm

6.1

percent

6,877

SEKm

5.9

times

8.30

SEK per share

1) After investments

2) Proposed by the Board

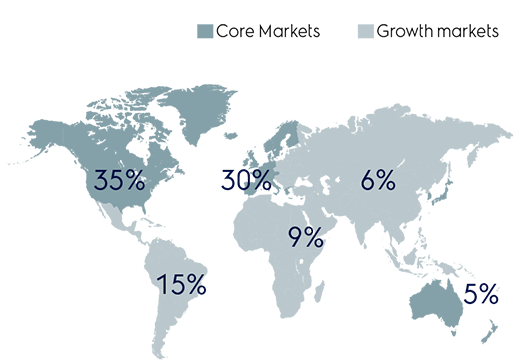

| Major Appliances Europe, Middle East and Africa, 32% | 32 |

| Major Appliances North America, 33% | 33 |

| Major Appliances Latin America, 14% | 14 |

| Major Appliances Asia/Pacific, 8% | 8 |

| Home Care & SDA, 6.5% | 6.5 |

| Professional Products, 6.5% | 6.5 |

Electrolux sells cookers, hobs, ovens, hoods, microwave ovens, refrigerators, freezers and dishwashers for households and professional kitchens throughout the world. Electrolux is a leader in kitchen appliances and new functionalities are continuously being developed.

Washing machines and tumble dryers are the core of the Electrolux product offering for washing and garment care. Demand is driven by innovations that promote user-friendliness and resource efficiency.

Electrolux vacuum cleaners, air-conditioning equipment, water heaters, heat pumps, small domestic appliances, and accessories are sold to consumers worldwide. Electrolux has a strong, global distribution network and an attractive product offering, including service.

64% share of Group sales of which 4% professional products

19% share of Group sales of which 2% professional products

17% share of Group sales