The global market for household appliances is changing, and includes the rapid emergence of an affluent middle class in densely populated growth markets. Electrolux aims to increase the share of sales of growth markets, while continuing to strengthen its position in core markets.

For simplification purposes, the global market for household appliances can be split into two parts. In mature markets (Western Europe, North America, Japan and Australia/New Zealand), population growth is low and sales are dominated by replacement products. However, emerging markets (Africa, the Middle East, Eastern Europe, Latin America, Southeast Asia and China) are characterized by rapidly rising standards of living and a large number of new households being able to invest in appliances and other household products.

The global market is driven and changed by a number of macroeconomic factors that influence volumes and the types of products that are in demand. Emerging economies with strong economic growth lead to a rapidly expanding and affluent middle class.

Changing life patterns lead, for example, to a trend in which households decrease in size, in terms of both living space and the number of individuals, and many consumers have less time for household chores.

Urbanization is continuing and will lead to over 60% of the world’s population living in cities by 20501). While this opens opportunities for sustainable solutions, it also entails an increased burden on infrastructure and resources, primarily energy.

Climate change and limited natural resources, together with increased awareness of the role households play in this development, mean that a growing number of consumers are demanding energy and resource-efficient products. Households currently account for 30% of all energy use and 20% of all carbon dioxide emissions2).

1) Population Division of the UN Department of Economic and Social Affairs, World Urbanization Prospects Report, 2014 Revision. 2) OECD

New technology and digitalization is being developed at a high pace and is rapidly being adopted globally. This allows the development of increasingly advanced products, such as connected products, and also leads to a significant rise in online sales as consumers are provided with easy ways to order goods and services via the internet.

Between 2010 and 2015, these macroeconomic drivers contributed to global demand for appliances. In 2015, the demand in growth markets represented about 70% of the total market volume for appliances compared with 65% in 2010. Since year 2000, emerging markets have increased their global share of demand from 50% to 70%.

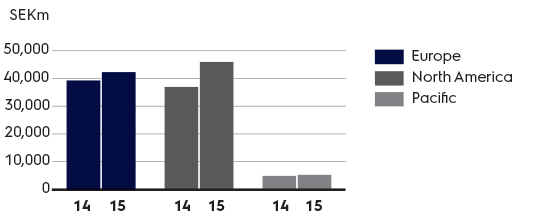

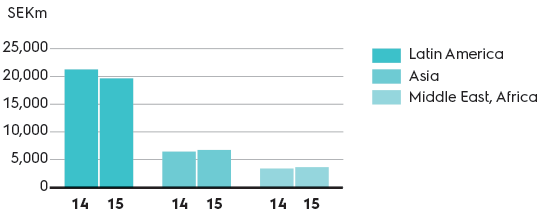

During 2015, demand improved in mature markets such as North America and Europe, while demand decreased in emerging markets such as Brazil and China.

Growth markets accounted for about 30% of Electrolux sales for the year and the objective is to increase this share moving forward.

Between 2010 and 2015, the global market demand for major appliances increased significantly, mainly due to strong growth in emerging markets. The Electrolux Group's strategy is to capitalize on this increased demand in growth markets.

Source: Electrolux estimates.

13%Population in Electrolux core markets

Western Europe, North America, Australia, New Zealand, Japan

87%Population in Electrolux growth markets

Africa, Middle East, Eastern Europe, Latin America,Southeast Asia, China

B/S/H

LG Electronics

Midea

Haier

Whirlpool

Samsung

Manufacturers and retailers of household appliances are becoming fewer, larger and more international. The five largest manufacturers of appliances in the world – Whirlpool, Electrolux, Haier Group, B/S/H and LG Electronics – accounted for almost half of global sales in 2015. In recent years, manufacturers from Asia have increased their market shares.

Electrolux has a number of key competitive advantages in the face of such intense competition.

Global presence generates economies of scale in the procurement of raw materials, components and finished products. Furthermore, global projects across all units contribute to a faster and more efficient product development process. In addition, an extensive global modularization program is ongoing that will increase efficency within production and reduce product costs.

Consumer insight is the basis for all products developed by the Group. By performing an extensive number of interviews and home visits, Electrolux gains knowledge of consumer behavior in the use of various household appliances and the needs that exist. Based on this information, Electrolux can develop solutions that facilitate the everyday lives of consumers.

Design is a central part of the Innovation Triangle, whereby the close collaboration between design, R&D and marketing enables new products to reach the market at a faster pace and ensures that these products are preferred by more consumers.

A distinct Scandinavian heritage plays a key role in shaping the Group’s design activities and in the development of new and sustainable appliances.

Professional expertise in the culinary arts contributes to creating innovative products for food preparation and preservation. To a great extent, this occurs through the transfer of know-how and experience from the professional business to the development of consumer products.

An extensive product range makes Electrolux a leading manufacturer of refrigerators, dishwashers, washing machines, cookers, air conditioners, vacuum cleaners and small domestic appliances, and the only player that offers complete solutions for both consumers and professional users.

Employees and culture play a crucial role in Electrolux achieving its targets and vision. Dedicated employees with diverse backgrounds create the innovative culture necessary for Electrolux to be successful. A passion for innovation, consumer insight and motivation to achieve results are at the core of all work at Electrolux.

Leveraging the leadership in sustainability means that Electrolux has a superior ability to develop smarter, more accessible and resource-efficient solutions that meet people's needs and improve living standards for an expanding middle class in growth markets.

Despite increasingly intense competition, Electrolux strengthened its positions in several key product segments in 2015. Electrolux kitchen products account for almost two-thirds of the Group’s sales and the company holds strong positions in all major categories of kitchen appliances and commands significant global market shares. The strongest global position currently held is for cookers, enabling, for example, know-how from Electrolux cooking solutions for the world’s best chefs and restaurants to be utilized when developing consumer appliances. In recent years, the Group has strengthened its leading position in built-in appliances through extensive product launches and partnerships with kitchen manufacturers.

The Group also holds strong positions in front-load washing machines and dishwashers, which are segments with low penetration in most markets. Electrolux offers restaurants and industrial kitchens complete solutions for cookers, ovens, refrigerators, freezers and dishwashers. The Group’s strongest position is in Europe, where about half of all Michelin-starred restaurants use kitchen appliances from Electrolux.

Electrolux also commands a strong global position in vacuum cleaners and is expanding in the area of small domestic appliances. The global market for small domestic appliances is significantly larger than the vacuum-cleaner market and has significantly faster growth.

Among adjacent product categories, Electrolux has identified major global potential for air-conditioning equipment and water heaters.

To build increased consumer awareness of the value of efficient products, Electrolux focuses on efficiency and other environmental benefits in its global marketing. Market surveys in Australia, Brazil, France, China, Germany and the US have shown that two-thirds of consumers ranked environmental impact as one of the three key factors when purchasing household appliances.