Risk assessment

Risk assessment includes identifying risks of not fulfilling the fundamental criteria, i.e., completeness, accuracy, valuation and reporting, for significant accounts in the financial reporting for the Group. Risks assessed also include risk of loss or misappropriation of assets.

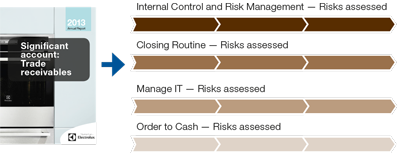

At the beginning of each calendar year, the Electrolux Control System Program Office performs a global risk assessment to determine the reporting units, data centers and processes in scope for the ECS activities. Within the Electrolux Group, a number of different processes generating transactions that end up in significant accounts in the financial reporting have been identified. For each process, key risks are identified and documented. See below examples of key risks within processes generating transactions to the significant account trade receivables.

All larger reporting units perform the ECS activities. These larger units cover approximately 72% of the total external sales and 58% of the external assets of the Group.

ECS has been rolled out to almost all of the smaller units within the Group. The scope for these units is limited to the four major processes Closing Routine, Order to Cash, Manage Inventory and Procure to Pay and predetermined key risks within these. The scope is also limited in terms of monitoring as management does not formally have to test the controls.

Risk assessment – Example trade receivables

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.