Keith McLoughlin retired from Electrolux in January 2016. Jonas Samuelson was appointed new President and CEO of Electrolux as of February 1, 2016.

| Share of group sales | |

| Major Appliances Europe, Middle East and Africa 30% | 30% |

| Major Appliances North America 35% | 35% |

| Major Appliances Latin America 15% | 15% |

| Major Appliances Asia/Pacific 7% | 7% |

| Small Appliances 7% | 7% |

| Professional Products 5% | 5% |

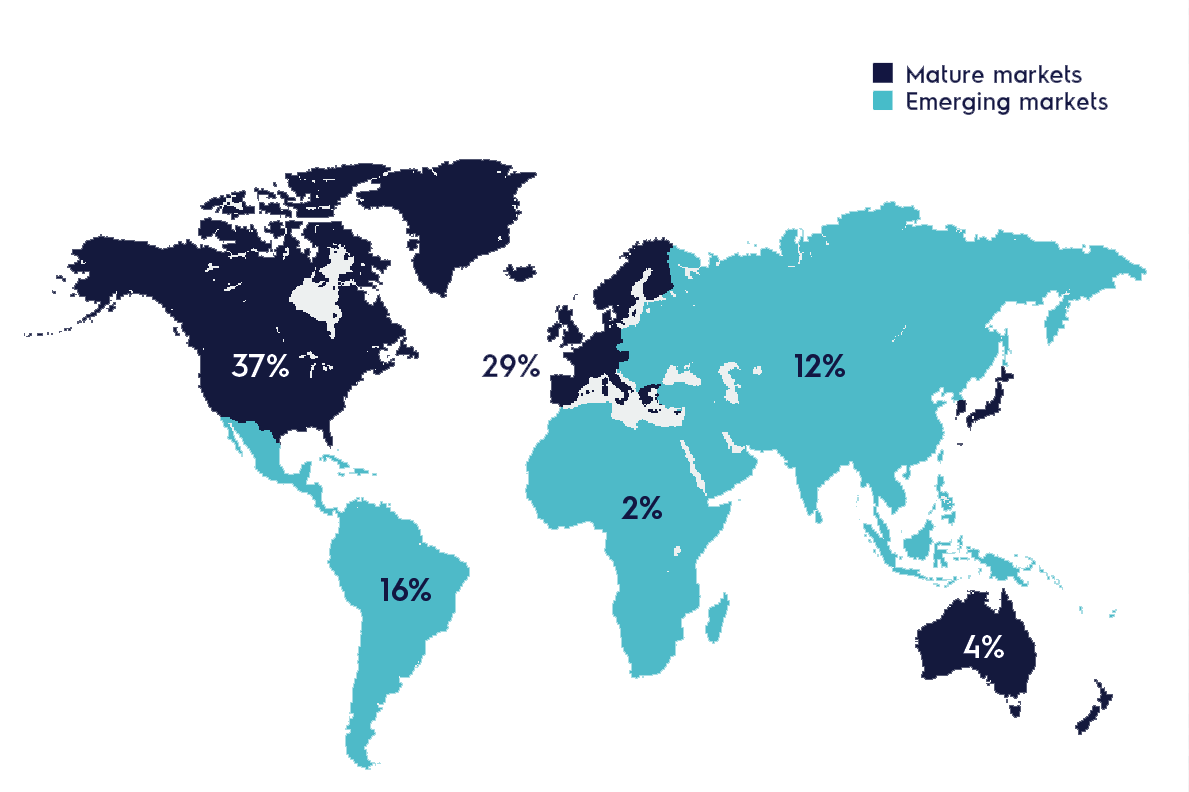

The Group’s products are sold in more than 150 countries. The largest of these in terms of sales are in North America and Europe. Electrolux is expanding its presence in growth markets, such as Latin America, Africa, the Middle East and Asia.

In 2015, Electrolux introduced a new visual identity for the company brand. A visual identity is much more than a change of logo and color palette. It represents a new sense of Electrolux as a brand, what we, our products and our services stand for and how we want to be perceived.

Strong focus on the most profitable product categories

continued to improve the product mix. Operating income improved significantly as a result of product mix improvements, higher sales volumes and increased efficiency.

| 11 | 12 | 13 | 14 | 15 | |

| Net sales | 101598 | 109994 | 109151 | 112143 | 123511 |

| Operating margin | 3 | 3.6 | 1.4 | 3.2 | 2.2 |

All business areas showed mix improvements during 2015 as a result of launches of new products and a strong focus on the most -profitable product categories. Price increases also contributed to the organic sales growth of 2.2%.

2.2%

Operating income declined and amounted to SEK 2,741m, corresponding to a margin of 2.2%. Major Appliances EMEA and Professional Products reported good development, while weak demand, particularly in emerging markets, had a negative impact on operating income.

Operating income includes costs of SEK 2,059m related to the not completed acquisition of GE Appliances. Excluding these costs, the margin was 3.9% (3.2).

Operating cash flow after investments improved to SEK 7,492m (6,631).

-50%

CO2 2020

Electrolux is cutting its climate footprint by 50% by 2020 relative to 2005 production levels. Approximately 25 million tonnes of CO2 equivalents will be cut in emissions deriving from product use, from production and transportation as well as from the use of greenhouse gases.

AEG – one of the Electrolux Group’s strategic brands – introduced a connected steam oven with the first ever integrated camera, giving consumers the tool to master cooking throug their mobile devices.

In 2015, Electrolux sponsored and co-hosted Taste Festivals across Europe, the Middle East and Australia. The festivals are a chance for consumers to taste food, cook on the latest appliances and engage directly with some of the best chefs in the world.

2,741

SEKm

6.50

per share

*proposed by the board