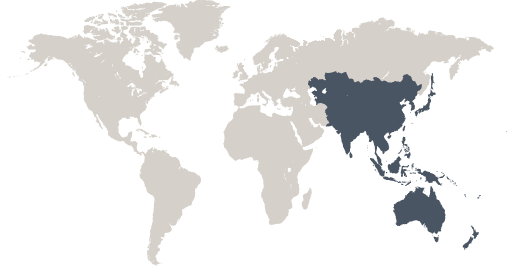

Sales of Electrolux appliances increased over the year due to rising demand in Southeast Asia and Australia where the Group holds market-leading positions. Operating income and margin improved.

Kenneth L. Ng, Head of Major Appliances Asia/Pacific

About half of Electrolux appliance sales in the region are in Australia, where the Group is the market leader. The Group’s Westinghouse brand commands strong positions in several product categories in the mass market segment. The Electrolux brand is positioned in the premium segment. Key competitors comprise Haier, Samsung and LG Electronics.

In Southeast Asia, Electrolux has a strong offering of premium products aimed at the rapidly expanding middle class, for example, energy-efficient front-load washing machines and built-in appliances for the kitchen. Water and energy efficiency are key drivers in the hot climate across the region. The Group’s front-load washing machines are well adapted to these conditions and have significant market shares.

China is the largest market for household appliances. The Electrolux market share of the Chinese market is relatively low, but there is considerable long-term potential for increased sales to the expanding middle class.

Overall market demand for core appliances in Australia, Southeast Asia and China is estimated to have increased during 2016.

Major Appliances Asia/Pacific reported an organic sales growth of 1.3%, largely due to increased sales in Southeast Asia. The trend was stable for Electrolux in the important Australian market.

In Australia, a new range of kitchen appliances was introduced under the Electrolux brand using the campaign theme “Discover the Electrolux life”, in parallel with continued marketing of the broad appliance product range launched in 2015 under the Westinghouse brand.

The review of the product offering and marketing strategy with the aim of improving possibilities for profitable growth continued in China. A new range of ovens and cookers was launched under the AEG brand during the latter part of the year.

During the year, the acquisition of Vintec was completed, a company based in Australia and Singapore with a leading position in wine cabinets in Australia and several other Asian markets. Vintec made a positive impact of 0.5% on sales.

The production unit in Orange, Australia was closed during the year and the transfer of production to Rayong in Thailand completed. In addition, the cold technology center for freezers and refrigerators research and development for Asia/Pacific and global platforms was relocated from Orange in Australia to Susegana in Italy. The regional distribution center for the Southeast Asian market in Singapore was moved to Thailand, which will generate cost savings and efficiency enhancements through its proximity to the Rayong plant. A number of activities were carried out over the year to highlight the importance of a quality focus across all parts of the operations.

8%

1.3%

| 12 | 13 | 14 | 15 | 16 | |

| Net sales | 8405 | 8653 | 8803 | 9229 | 9380 |

| Operating margin | 8.9 | 1.3 | 5 | 3.9 | 6.7 |

Organic sales increased by 1.3%. Sales in Australia and New Zealand increased mainly as a result of an improved mix development. Sales in Southeast Asia also improved as a result of higher sales volumes across most product categories.

Operating income and margin improved primarily due to increased cost efficiency and a favorable earnings trend in Australia and Southeast Asia.

3,493

Retailers across Australia “Discovered The Electrolux Life” at evening presentations of the new cooking and refrigeration ranges in Brisbane, Sydney and Melbourne. The highlight was the guests’ meals assembled and cooked by chefs and restaurateurs using the new Electrolux induction cooktops and ovens and the freshest ingredients delivered from the new Electrolux FreshPlus™ refrigerator range.

The Westinghouse brand is the major Electrolux brand in Australia. New ranges of cooking and refrigeration appliances under the Westinghouse brand were launched. This was one of the largest launches in Australia in recent years. These new appliances are designed to meet the demands of today’s family life, including clever functions such as fridges that are really big on space so that everything fits in and ovens that have a steam-assist function and clean themselves.

A new range of ovens and cookers was launched under the AEG brand in China during the year. AEG appliances are designed to deliver highly intuitive cooking experiences. One example is Sous-Vide cooking to create restaurant-quality gastronomic delights at home.