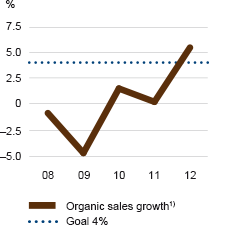

Average growth of at least 4% annually

In order to achieve higher growth than the market average, the Group continues to strengthen its positions in the premium segment, expand in profitable high-growth product categories, increase sales in growth regions and develop service and aftermarket operations. In addition to organic growth, opportunities exist for implementing the Group’s growth strategy more rapidly through acquisitions. Growth for Electrolux improved to 8.3% in 2012, of which 5.5% was organic growth, 3.9% acquisitions and –1.1% changes in exchange rates. This surpassed the goal and was the highest rate of growth in the company in its current structure.

Sales growth |

|

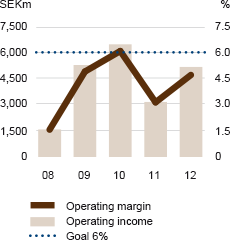

Operating margin of at least 6%

By maintaining its focus on innovative products, strong brands and improved operational excellence, Electrolux can achieve a high level of profitability despite weak core markets. In 2012, Electrolux achieved an operating margin of 4.7%, excluding items affecting comparability.

Three of the Group’s six business areas achieved an operating margin of more than 6%. The operating margin will continue to fluctuate due to changes in general economic conditions and trends in the household appliance market.

Operating margin |

|

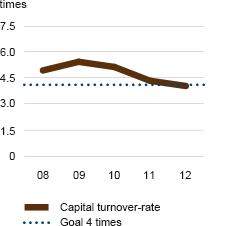

Capital turnover-rate of at least 4 times

Electrolux strives for an optimal capital structure in relation to the Group’s goals for profitability and growth. In recent years, work on reducing working capital has been intensified. It has resulted in a lower level of structural working capital as well as a stronger cash flow. When demand and sales accelerate again, even greater focus will be required to limit the degree of capital intensity. Reducing the amount of capital tied up in operations creates opportunities for rapid and profitable growth. The capital turnover-rate decreased to 4.0 times in 2012.

Capital turnover-rate |

|

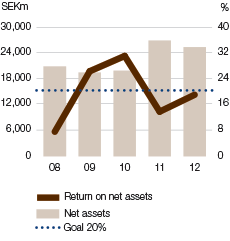

Return on net assets of at least 20%

Focusing on growth with sustained profitability and a small but effective capital base enables Electrolux to achieve a high long-term return on capital. With an operating margin in excess of 6% and a capital turnover-rate of at least four times, Electrolux would achieve a return on net assets (RONA) of at least 20%. The figure reported for 2012 was 18.8%.

Return on net assets |

|