The European market grew during the year. Electrolux earnings continued to improve as a result of clear focus on the most profitable product categories in combination with increased cost-efficiency.

Dan Arler, Head of Major Appliances Europe, Middle East and Africa

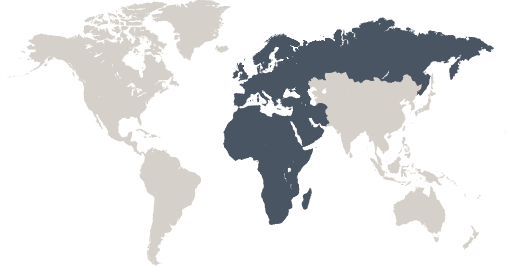

EMEA comprises the Group’s largest market and Electrolux has a broad offering under its three main brands: Electrolux, AEG and Zanussi. In many countries and segments, the Group has strong market positions with a particularly strong position in kitchen appliances, such as cookers, hobs and built-in appliances.

The total European appliance market grew by 3% in 2016, demand increased in most markets.

Intense competition between a large number of manufacturers, brands and retailers resulted in continued price pressure in the market.

In the Middle East and Africa, the Group holds a smaller position with considerable potential. Africa and the Middle East comprise a large number of countries with significant variation in terms of wealth and degree of urbanization. A common theme is that demand for appliances rises in parallel with growing prosperity. Electrolux has a growth strategy targeting primarily Egypt, Saudi Arabia and a number of countries in the Lower Gulf Region.

Major appliances EMEA posted organic sales growth of 3.5% for the year. Sales increased in several key markets in Western Europe and Eastern Europe. Focus remained strong on the most profitable product categories and the Group continued to capture market shares in the premium segment. In November, Electrolux signed an agreement to acquire South Africa’s leading manufacturer of water heaters, the Kwikot Group. The acquisition means Electrolux broadens its offering in the Home Comfort product range and creates excellent prerequisites for continued growth in Africa.

During the year, two new, innovative product ranges were launched under the AEG brand. The Mastery Range of kitchen products includes a complete range of innovative kitchen products such as an oven that asks how you would like your meat cooked and a dishwasher that gently lifts the lower basket to facilitate loading. The new range of washing machines and tumble dryers focuses on gentle treatment of clothing.

During the year, the ongoing initiatives to increase efficiency within operations and manufacturing continued. In addition, the Electrolux Continuous Improvements Program was initiated, which comprises a cross-functional approach to raise customer value and reduce costs, thereby leading to increased cost-efficiency in many areas. A project in Germany that led to improvement of the process from order to cash is one such example.

The washing machine plant in Egypt implemented a streamlining project under the Electrolux Management System, which resulted in a 25% productivity increase in parallel with improved quality and safety.

The Spares Excellence Program was implemented during the year with the objective of reducing the spare parts quantities held in Europe by 40% by 2020.

Other focus areas during the year included activities to increase automation and improve safety in manufacturing.

31%

3.5%

| 12 | 13 | 14 | 15 | 16 | |

| Net sales | 34278 | 33436 | 34438 | 37179 | 37844 |

| Operating margin | 0.5 | -1.4 | 0.7 | 5.8 | 6.7 |

Major Appliances EMEA reported organic sales growth of 3.5% in 2016. This growth was mainly a result of increased sales volumes and an improved product mix, which offset continued price pressure.

Operating income and margin improved significantly, mainly as a result of product mix improvements, increased cost efficiency and higher sales volumes.

20,2016

In 2016, two new, innovative product ranges were launched under the AEG brand; The Mastery Range of kitchen products and a range of washing machines and tumble dryers. It includes a dishwasher that gently lifts the lower basket to facilitate loading and a hands-free hood that automatically adjusts to cooking activity on the cooker. Part of the new laundry range has a no fading guarantee for up to 50 washes.

Sous-vide cooking has been used in professional kitchens for years and Electrolux has applied the concept to its steam ovens for consumers. Sous-vide cooking means cooking food under vacuum and the raw food is vacuum-sealed in plastic bags. The food can be cooked for longer than normal cooking times. This means that the food is cooked evenly without overcooking while maintaining almost all of the original juices and flavors providing a great taste experience.