Mission – financial goals

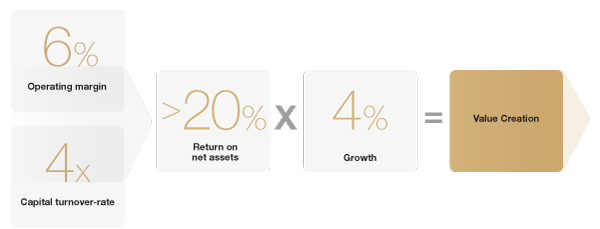

The Electrolux mission towards its shareholders is defined by the company’s financial goals and measured by their outcome. In addition to maintaining and strengthening the Group’s leading, global position in the industry, achieving the financial goals will contribute to a healthy total return for Electrolux shareholders.

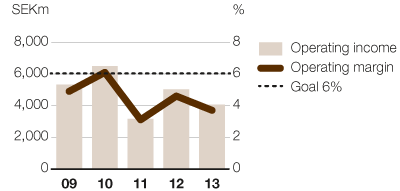

Operating margin of at least 6%

Electrolux can achieve a high level of profitability by maintaining its focus on innovative products, strong brands and enhanced efficiency. In 2013, the most efficient products, the Electrolux Green Range, represented 12% of products sold and 24% of gross profit. The Group’s operating margin was 3.7%, excluding items affecting comparability. Weak markets in Europe and unfavourable currency movements impacted earnings in 2013, although Major Appliances North America and Professional Products showed an operating margin well above 6%.

Operating margin

|

Goal |

Result 2013 |

|---|---|

| 6% | 3.7% |

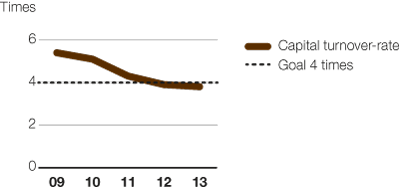

Capital turnover-rate of at least 4 times

Electrolux strives for an optimal capital structure in relation to the Group’s goals for profitability and growth. In recent years, work on reducing working capital has been intensified. It has resulted in a lower level of structural working capital. Reducing the amount of capital tied up in operations creates opportunities for rapid and profitable growth. The capital turnover-rate was 3.8 times in 2013. The acquisitions in 2011 of Olympic Group in Egypt and CTI in Chile have impacted the capital turnover-rate negatively.

Capital turnover-rate

|

Goal |

Result 2013 |

|---|---|

| >4 x | 3.8 x |

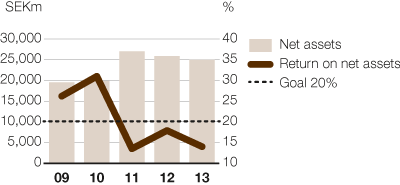

Return on net assets of at least 20%

Focusing on growth with sustained profitability and a small but effective capital base enables Electrolux to achieve a high long-term return on capital. With an operating margin that achieves the target of 6% and a capital turnover-rate of at least four times, Electrolux would achieve a return on net assets (RONA) of at least 20%. The figure reported for 2013 was 14.0%. The acquisitions in 2011 of Olympic Group in Egypt and CTI in Chile have impacted the return on net assets negatively.

Return on net assets

|

Goal |

Result 2013 |

|---|---|

| >20 % | 14 % |

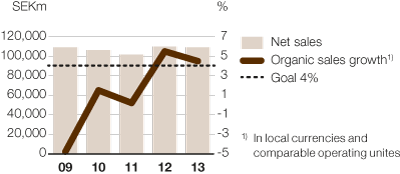

Average growth of at least 4% annually

In order to reach the growth goal, the Group continues to strengthen its positions in the premium segment, expand in profitable high-growth product categories, increase sales in growth regions and develop service and after-market operations. More rapid implementation of the growth strategy allows organic growth to be complemented by acquisitions. In 2013, sales declined by –0.8%, due to changes in exchange rates. The organic sales growth was 4.5%, while currencies had a negative impact of –5.3%.

Sales growth

|

Goal |

Result 2013 |

|---|---|

| >4 % | 4.5 % |

CEO Statement

In 2013 we continued to deliver above our growth target and delivered 4.5% in organic sales growth.

CEO Statement

I'm convinced that raising product efficiency for the growing middle class is where long-term shareholder value creation lies.

Our products

Electrolux is the only appliance manufacturer in the industry to offer complete solutions for both consumers and professionals. The focus is on innovative and energy-efficient products in the premium segments.

Sustainability

Achieving the Group's vision of sustainability leadership is crucial to realizing the business strategy. The objective is to develop smarter, more accessible, resource-efficient solutions that meet people's needs and improve their lives. Read the comprehensive sustainability performance review.

Awards & recognition

Financial Reporting

Net sales for the Electrolux Group in 2013 amounted to SEK 109,151m, as against SEK 109,994m in the previous year. The organic sales growth was 4.5%, while currencies had an impact of -5.3%.