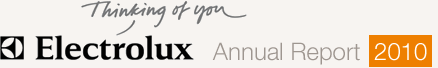

The operations in Professional Products have gone through a profitable transformation. Profitability has steadily increased and in 2010, the highest operating margin ever was recorded – 11.6%. The strategy to offer an innovative product range in combination with strict cost control is paying off.

Net sales declined in 2010 as the Group exited a contractor of larger kitchen products in North America.

Professional Laundry equipment

Trends

Requirements for professional laundry equipment vary somewhat among users. For example, laundry specialists demand ergonomic products and solutions that reduce the risk of spreading infection through soiled textiles. Laundry equipment for laundry rooms in apartment buildings or in laundromats must be so easy to use that no manual is required. Irrespective of the area of use, buyers demand innovations that cut costs by reducing consumption of energy, water and detergents while still maintaining satisfactory washing and rinsing performance.

Markets and dealers

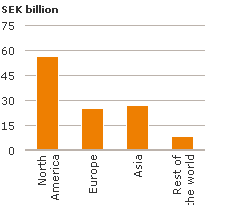

Professional laundry equipment is sold to laundry specialists such as those serving hospitals and hotels and also directly to apartment block owners and local laundries. In 2010, the global market for professional laundry equipment was estimated at approximately SEK 20 billion. Although demand declined during the recent recession, the market for professional laundry equipment has proven more stable than the market for food-service equipment, since replacement equipment accounts for a large portion of sales.

The market for professional laundry equipment is less fragmented than the market for professional food-service equipment. The five largest producers represent approximately 55% of the global market. The proportion of direct sales is greater for laundry equipment than for food-service products, although the trend is towards a growing share of sales through dealers, particularly for more standardized products.

The Group’s position

Electrolux maintains a program for the continuous development of new, user-friendly products and laundry processes that reduce energy consumption and improve washing performance. The product offering includes washing machines, tumble-dryers and ironing equipment. Approximately 65% of sales are in Europe and 10% in North America. Currently, the Group’s strongest positions are in European hospitals and commercial laundry specialists. Electrolux products are distributed through 20 sales companies worldwide as well as through a global network of independent distributors.

Electrolux Lagoon™ is a washing, drying and ironing system that utilizes only biologically degradable detergents and water. It provides a gentle, ecological wash even for materials that normally require dry-cleaning, such as wool and leather.

Electrolux sells front-loaded washing machines that utilize a technology, Automated Weighting System (AWS), to weigh the laundry and then adjust the amount of water, energy and detergent to the weight of the load.

The Electrolux tumble-dryer, the Heat Pump Dryer, consumes approximately 70% less energy than a tumble dryer with a conventional heating system for drying laundry.

Modern Coin-op in Belgium equipped with laundry solutions from Electrolux Professional Products. This customer segment is one of the focus areas for growth in professional consumer-operated solutions.

Professional Food-service equipment

Trends

Since buyers of food-service equipment have varying requirements, producers must be able to supply innovative flexible solutions. End-users are focusing increasingly on hygienic criteria, water efficiency, energy efficiency and access to a comprehensive service network. The importance of design is increasing steadily, as many restaurant kitchens are in full view of guests.

Markets and dealers

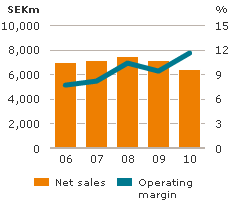

The market for professional food-service equipment was estimated at approximately SEK 116 billion in 2010. After a weak 2009, demand stabilized in Western markets and increased in Asia and Latin America. Within the various segments, large global restaurant chains showed continued growth. In Europe, public institutions and independent restaurants continued to show weak demand.

Approximately half of all food-service equipment in the industry is sold in North America. The major restaurant chains are increasing their market shares in the US and are expanding rapidly in growth markets, including China and Eastern Europe, thus generating extensive opportunities for producers of food-service equipment for restaurant chains. The North American market features a relatively high degree of consolidation among both producers and dealers of professional food-service equipment.

The European market is about half the size of the North American market and is dominated by many small independent restaurants. Consolidation among producers and distributors has not come as far as in the US, and many European producers specialize in a specific product, sector or market. Ongoing harmonization of legislation and directives in the EU will benefit major producers that can better adapt to more stringent standards.

The Group’s position

Electrolux is the only producer in the market that can provide restaurants and professional kitchens with complete solutions involving the most important kitchen appliances, such as dishwashers, refrigerators and freezers. Electrolux also offers customers individual high-performance innovative products. The Green Spirit range offers best-in-class environmental performance and furnishes the Group with a competitive edge, since an increasing number of users are focusing on reducing their energy consumption.

Most Electrolux food-service equipment is sold through dealers. This strategy has proven to be more successful and cost-effective than direct sales, in view of the complex end-user structure. A great deal of this equipment is sold as a complete kitchen solution, and buyers often depend on dealer assistance for selecting appropriate functions.

In Europe, Electrolux has a strong position with independent restaurants and healthcare facilities. The Group also supplies equipment for major projects such as hotels and cruise liners. Electrolux has a global presence.

In the US, Electrolux has focused on establishing strong links with the major fast-food chains in recent years. The number of small establishments that serve hot food is growing rapidly in the US and in growth markets. Electrolux has developed competitive solutions to meet the needs of large chain customers such as rack-type dishwashing and the High Speed Panini Grill.